.jpg) Former small group health care enrollees are slowly bleeding into the individual market, and this could result in rising premiums, fewer plan options and greater financial burdens for small business owners. Small group market membership has experienced a gradual decline at least as far back as early 2018, while individual market membership has experienced significant increases in recent years.

Former small group health care enrollees are slowly bleeding into the individual market, and this could result in rising premiums, fewer plan options and greater financial burdens for small business owners. Small group market membership has experienced a gradual decline at least as far back as early 2018, while individual market membership has experienced significant increases in recent years.

In 2022, NH’s individual market enrollment increased by 4,000 enrollees from 2021, accounting for 59,900 people. The number of Granite Staters enrolled in small group market plans—for groups of 1 to 51 people—decreased from 63,600 people in 2021 to 63,100 in 2022, according to the NH Insurance Department.

While the shift to individual markets isn’t drastic, it is of high concern says NH Insurance Department Commissioner D.J. Bettencourt. “We are a small business state, and our businesses need the ability to access coverage for their employees and they need to be able to access coverage that is affordable to them,” he says. “Finding solutions for this is a priority.”

During COVID, the large group market—51 or more employees—shrank, and the small group market expanded because large groups were laying people off, says Maria Proulx, Anthem Blue Cross and Blue Shield president for NH. “They were falling under 50 employees, which could balloon your small group, but since COVID we’ve seen groups hiring back,” she says. “Now they’ve moved from small to large, and the one market that has expanded in the last few years is the individual market.”

A Shrinking Small-Group Pool

Proulx says there are several reasons for the shift of enrollments to the individual market. She cites the expansion of Medicaid in the early part of the COVID-19 pandemic as one reason for the shift.

“The American Rescue Plan at the federal level expanded Medicaid because people were losing their jobs and were under employed,” Proulx says, explaining that this expansion has ended and that states are moving back to pre-pandemic era Medicaid levels. “What we’ve seen is that people are coming off the rolls of Medicaid and now they’re going into the individual market.”

Another reason for the shift, Proulx says, are federal subsidies, such as those that came through the American Rescue Plan Act (ARPA). “That gave more individuals more money to buy individual policies, and we’ve seen that those subsidies have been extended to 2025.”

Another reason for the shift, Proulx says, are federal subsidies, such as those that came through the American Rescue Plan Act (ARPA). “That gave more individuals more money to buy individual policies, and we’ve seen that those subsidies have been extended to 2025.”

Still other reasons for people moving to the individual market include the rise of Individual Coverage Health Reimbursement Arrangements (ICHRA) and reinsurance waivers, Proulx says.

An ICHRA is a relatively new type of health benefit offered by employers of any size to reimburse their employees for some or all of the premiums they pay for individual health insurance plans purchased on their own. Any employer, regardless of size, can offer an ICHRA.

A 1332 Insurance Waiver, authorized under Section 1332 of the Affordable Care Act (ACA), allows individual states to request specific flexibilities from certain ACA requirements to design alternative approaches for providing affordable and accessible health insurance to their residents.

“I think one of the big reasons for the individual expansion in New Hampshire is the 1332 reinsurance waiver,” Proulx says. “It helps balance the risk pool. When we did it in 2021, it lowered the individual rates by about 15%.”

The Biden-Harris Administration announced in late January that 21.3 million people selected an Affordable Care Act Health Insurance Marketplace plan during the 2024 Open Enrollment Period. Total plan selections include more than five million people—about a fourth—who are new to the Marketplaces and 16 million people who renewed their coverage.

“Once again, a record-breaking number of Americans have signed up for affordable health care coverage through the Affordable Care Act’s Marketplace,” HHS Secretary Xavier Becerra said in a January news release.

|

The Business of Controlling Costs |

|

|

|

|

The complexities and high expenses of health care have created a marketplace for firms that help companies and their employees navigate the health care system. Among them is Delphi LLC, a NH-based firm that offers a Bundle Payment Program to create a continuum of care, from surgery to physical therapy—and receive just one bill. Delphi originated as a bundle payment program and has built another product line that helps people with access of care issues, says company President Andrew Vailas, explaining that Delphi is not an insurance company. “The average person doesn’t have $1,000 in their savings and if you go for an MRI, that’s $5,000 and you just bankrupted that person overnight,” says Vailas. “But we can help them find low-cost providers if they’re eligible, and now they’re not on the hook for as much. The leading cause of bankruptcy in the United States is medical related. And that’s just wrong.” But pricing isn’t the only major concern patients have, says Vailas. “What they were concerned with is, ‘Can I go to this place? How do I get there? Is who I’m seeing in network, and can I actually get an appointment with them?’” says Vailas. “We still help with pricing, but our primary focus is getting people where they need to go when they need to get there.” Originally Delphi was working with large group self-insured employers, which pay out of their own pocket for health care related costs. But Delphi realized that small companies often need more help. “When you’re part of a small group, you’re subject to whatever plan you’ve been proposed with,” he says. Delphi works with more than 30 providers in NH, at three different facilities: Bedford Ambulatory Surgical Center, Orchard Surgical Center, and Surgery Center of NH. |

|||

Smaller Risk Pools Could Mean Higher Costs for Small Businesses

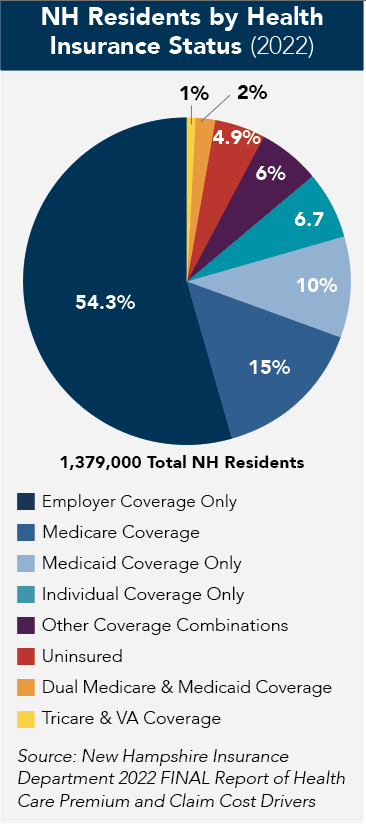

While more individuals overall receive health care coverage—as of 2022, around 95% of the population in NH had health insurance coverage at some point during the year—the shrinking small-group sector could pose long-term problems. With fewer participants to spread the risk, small businesses may face higher premiums for their employees. “The smaller that market is, the less money there is to pay for people to get coverage,” says A.J. Kierstead, consumer outreach coordinator at the NH Insurance Department. “So, it will, over time, increase premiums.”

And a smaller pool of enrollees can make it less attractive for insurers to offer diverse plan options. This could limit employees’ choice of coverage and their ability to find plans that meet their needs, says Proulx.

“What will be interesting to see is at the end of 2024, did we see growth back into the small group and large group markets?” Proulx says, explaining that such growth could depend on whether people that were formerly eligible for Medicaid reenter those markets.

Tim Steele, CEO of Microspec in Peterborough, says the company’s policy is coming up for renewal and that he’s considering changing plans. Microspec, which has 105 employees, makes surgical tubing that is sold to medical device manufacturers around the country. “I’ve already been told by the insurance agents that our rates are going up 18%,” he says. “Last year, they went up 28%. We write a check monthly for $70,000. It’s painful.”

Microspec pays at least 90% of the premium for each employee and paid 100% in the past, Steele says. For dental insurance, the company is self-insured and offers each employee $1,500 for dental care.

According to the National Association of Health Underwriters, the average monthly premium for small businesses with 51 to 100 employees in the United States was $688 per employee in 2023. In NH, the average monthly premium for employer-sponsored health insurance across all plan types and company sizes was $632 per employee in 2022.

Bettencourt says small businesses can look at what their arrangement is for their small group policy and compare that to the cost to move to an ICHRA arrangement. “We don’t know yet how many of those businesses will determine whether the ICHRA is financially advantageous. What we do know is that there will be further decline in the small group market,” he says. “The reality is that this is about risk bearing, and you need a certain amount of people in that pool to take risk on that population.”

Looking for Answers

The NH Insurance Department has hired a consulting firm with expertise in understanding the small group market and the dynamics that this market is facing, Bettencourt says, adding a report is expected this spring.

“[The report] is about figuring out what the future of health insurance coverage for small business is going to look like,” Bettencourt says, adding the state is hoping the report will provide solutions to shore up the small group market.

“Is it inevitable that the ways small businesses access health insurance coverage are going to look dramatically different in the next five to 10 years than today? And if so, what does that look like? And how can we ensure that businesses can offer their employees coverage at rates that are affordable?” he says.

Bettencourt says that absent dramatic changes to federal or state law, the trend away from the small group market is going to continue. “Then we’re going to have to figure out, as I said, what that transition looks like.”