One of the biggest lures to exploring the path of entrepreneurship or small business ownership is the potential for financial independence and increased earning capacity. While possible, it can require changing how you view and plan your finances in the areas of taxes, compensation and benefits and may depend on how the business is legally structured.

Understanding State Business Taxes

While NH residents do not pay state income taxes, the same cannot be said for NH businesses. All businesses, regardless of entity type, are subject to the NH Business Profits Tax and NH Business Enterprise Tax.

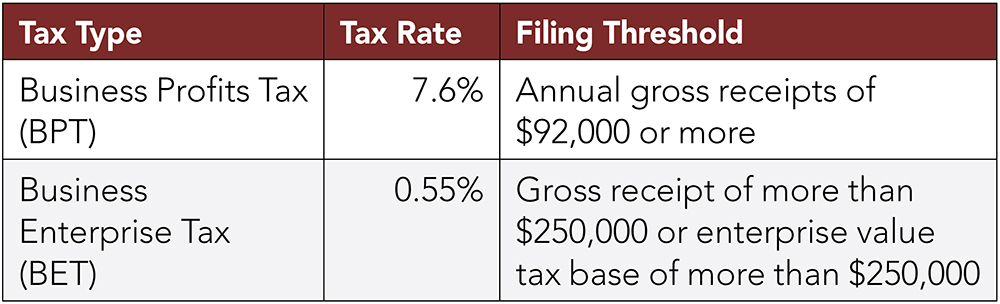

Changes to the state tax laws in recent years have lowered the rates and increased the filing thresholds. For tax periods ending on or after Dec. 31, 2022, the NH business tax rates and filing thresholds are as follows:

“Enterprise value tax base” is the sum of all compensation paid or accrued, interest paid or accrued, and dividends paid by the business.

New business owners that are not familiar with and do not plan for the payment of these state-level taxes can be in for an unwelcome surprise when it comes time to file their taxes. Failure to file and pay NH business taxes in a timely manner can result in a tax lien on an owner’s business assets, as well as fines and penalties. Setting aside funds for these tax obligations is an important part of planning for business finances.

Understanding Federal Business Taxes

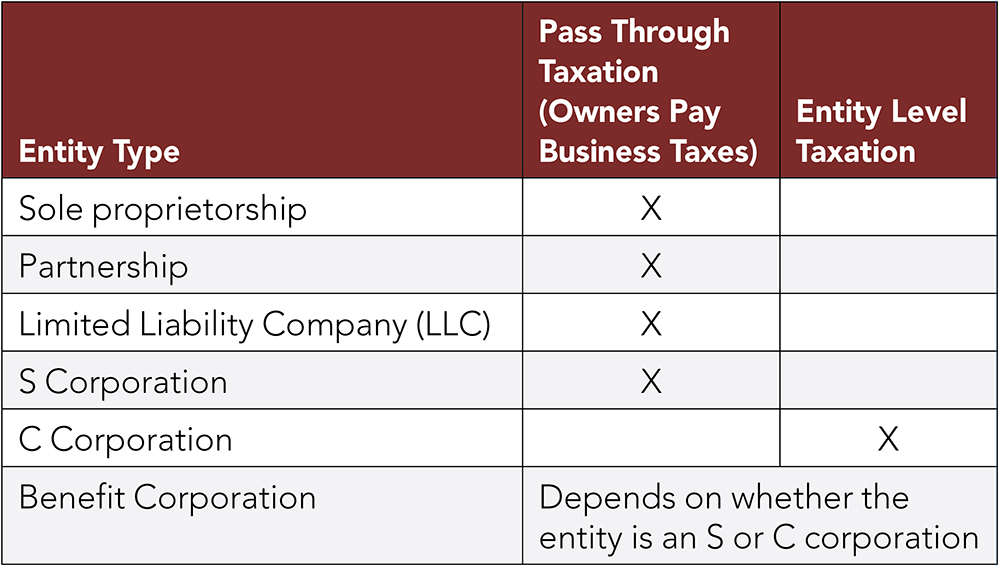

While NH state taxes apply to all businesses regardless of entity choice, which businesses pay federal income tax is very much related to entity structure. Certain corporations, commonly referred to as C corporations, must file their own corporate tax return and pay taxes on their own at the established corporate tax rate. If there are profits that are distributed to the owners of the C corporation, each owner must pay taxes on the amount of profit received. This is often referred to as “double taxation.” For most other types of business entity, taxes are not paid at a corporate level or at the corporate tax rate. Instead, the owners will report the profits and losses on their individual tax returns. The amount of tax paid by each owner of the business is based upon that owner’s individual tax rate and the proportion of the business owned by that partner. This type of tax treatment is referred to a “pass through” taxation.

This chart summarizes the federal tax treatment of common entity choices:

As noted in the chart, there is no separate tax classification for B corporations (or Benefit Corporations). A B corporation can be taxed as an S corporation or a C corporation depending on its overall entity structure.

Most federal income taxes associated with ownership of a business are going to be paid directly by the owners rather than as a separate obligation of the entity, and those obligations are going to be due and payable in April of each year with the filing deadline for individual federal income tax returns. Business owners should be regularly monitoring business profitability and setting aside funds from the business to cover the tax obligations to avoid unwelcome surprises in April.

Understanding Owner Compensation and Benefits

You may be ready to conclude that pass through entity structures are the best choice for managing business finances as they avoid a double taxation structure. However, taxation is only part of the analysis. The goal of increased earning capacity and financial independence require that the business be able to pay you from time to time in order for you to meet your personal needs.

Operating a business as a sole proprietorship, partnership or LLC means that the business owner(s) will be designated as self-employed for compensation and benefit purposes. This means that business owners are not paid regular compensation with withholdings for Social Security and unemployment under a typical salary or payroll structure. Business owners, instead, take compensation in the form of owner draws or guaranteed payments and are responsible for paying self-employment taxes. They are also ineligible to participate in many employee benefits plans, such as 401(k) plans, as they are not deemed employees of the business. All of this means that business owners must plan their finances carefully, set aside funds for paying self-employment taxes and set up retirement and health care savings apart from group benefit plans. In other words, finances for business owners require good planning and discipline.

For business owners wanting to take regular salary and participate in group benefit plans, operating as an S corporation or C corporation may address this particular objective. However, in the early days of a new business, when revenue is not consistent, the business may not be able to support ongoing and continuous payroll obligations and group plans may be too expensive to set up and administer.

The key takeaway for business owners considering how choice of entity will affect their finances is to know that the initial decision about entity structure is never carved in stone and will likely need to be revisited over time as the business grows and develops. Plan for what the business can support in the near term and be open to adapting entity and tax structure over time.

Kristin Mendoza is the principal and founder of Abridge Law PLLC, a law firm in Nashua that serves entrepreneurs and small business clients in NH and Massachusetts. She can be reached at 603-318-2002 or visit abridgelaw.com.