Concord Hospital and others in the state say Anthem Blue Cross Blue Shield is behind on payments and slow to resolve billing disputes. (Annmarie Timmins | New Hampshire Bulletin)

Concord Hospital and others in the state say Anthem Blue Cross Blue Shield is behind on payments and slow to resolve billing disputes. (Annmarie Timmins | New Hampshire Bulletin)

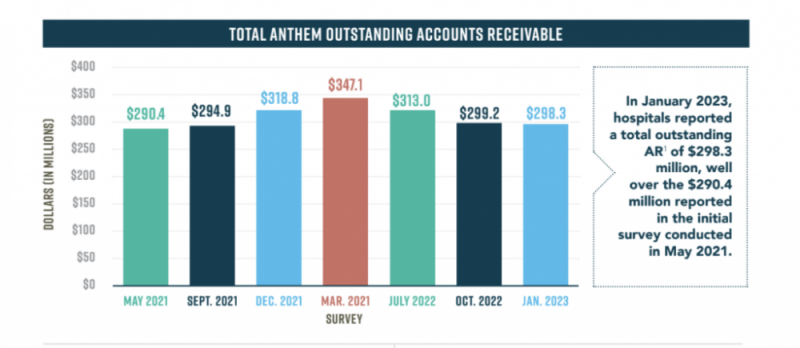

Anthem Blue Cross and Blue Shield, the state’s largest insurance company, owes the state’s hospitals nearly $300 million in unpaid claims, according to a report released Wednesday by the New Hampshire Hospital Association. It said Anthem has not followed through on promises made in 2021 to improve its handling of claims.

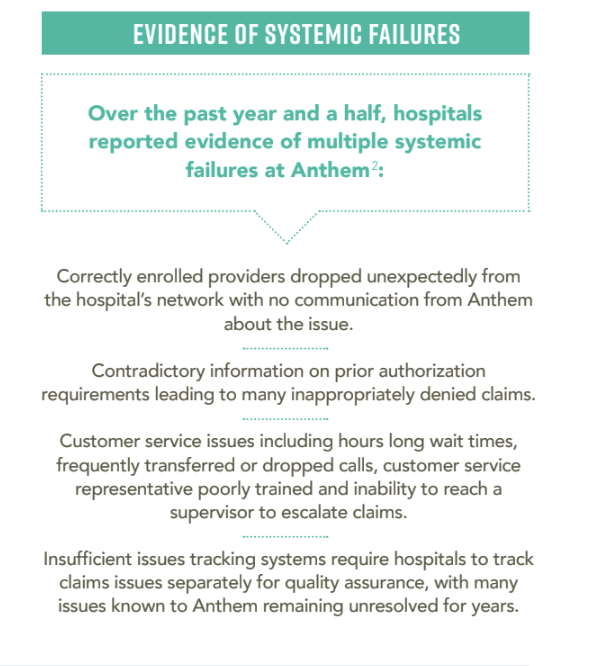

The report also alleges that Anthem’s internal systems are so flawed that it’s charging higher out-of-network prices for providers that are in its network; it is not responding for days or longer when providers question a claim denial; and it is breaking state law that requires some claims to be paid within 15 to 30 days.

The report alleges that Anthem’s internal benefits management system misrepresents what procedures need prior authorization. It then denies claims that are not pre-approved after saying prior authorization was not required, according to the report.

Anthem has faced similar complaints from hospitals across the country. Some have sued and others have parted ways with the insurer. Georgia fined Anthem $5 million for failing to pay claims in a timely manner, Becker’s Hospital Review reported last year.

In an email, the spokesman for the New Hampshire Insurance Department said state law prohibits the office from commenting on whether the office has received complaints about Anthem’s claim processing or has taken action against the company.

In 2021, after the hospital association first raised concerns about Anthem’s overdue payments, an insurance department spokesperson told told New Hampshire Public Radio that it was aware of the unpaid claims and was monitoring the situation.

Anthem spokesperson Stephanie DuBois disputed the report’s allegation that it owes hospitals $298.3 million in unpaid claims. In an email, DuBois said too that the report fails to note that a “large portion” of unpaid claims older than 30 days have been appropriately denied and remain in dispute.

“It’s commonplace to have some claims outstanding and even disputed after adjudication given the volume of daily submissions, and the review required to ensure claims are coded, billed, and paid correctly,” DuBois said.

The vast majority of claims it has paid have been paid quickly, DuBois said.

“To put things in perspective, over the last 12 months 92 percent of New Hampshire claims have been processed within 14 days, and 98 percent within 30 days,” she said. According to DuBois, Anthem paid $1.28 billion in claims payments to New Hampshire hospitals in the last 12 months, the vast majority within 30 days.

She declined to say how much Anthem believes it owes hospitals.

The New Hampshire Hospital Association is calling on Anthem to pay what is says are nearly $300 million in unpaid claims. (Screenshot, New Hampshire Hospital Association)

The New Hampshire Hospital Association is calling on Anthem to pay what is says are nearly $300 million in unpaid claims. (Screenshot, New Hampshire Hospital Association)

Steven Ahnen, president and chief executive officer of the New Hampshire Hospital Association, stood by the report in an interview Thursday.

“What would Anthem suggest is an appropriate number?” Ahnen said. “Is it $200 million that they owe hospitals? Is it $100 million? $150 million? That’s not the point. The point is, we have to chase Anthem to try and process claims that we shouldn’t have to do. It requires significant amounts of staff time and effort. That shouldn’t be the case.”

The New Hampshire Hospital Association began hearing complaints from hospitals about Anthem’s handling of claims in early 2021, the report said. A subsequent survey of hospitals showed “universal dissatisfaction with Anthem’s practices, procedures, and overall performance,” the report said.

The association said it shared those results with Anthem in mid-2021. For the next year and a half, representatives from the association and hospitals met at least every other week with Anthem to resolve providers’ complaints. Those conversations, which lasted until December, produced “minimal improvements,” the report said.

The New Hampshire Hospital Association laid out its frustrations and concerns in its seven-page report. It said Anthem’s overdue payments and flawed claims processing systems have led hospitals, struggling to recover from pandemic expenses and staff losses, to write off unpaid bills and devote hours of staff time attempting to resolve issues with Anthem.

Catholic Medical Center is among the providers awaiting past-due payments.

“It’s no secret that hospitals across the state and country have been financially impacted by the pandemic,” said spokesperson Laura Montenegro in an email. “We are grateful to the New Hampshire Hospital Association for their efforts to assist in the collection of overdue payments and we look forward to working with Anthem to resolve the backlog of claims for the critical care our staff provides daily for patients

DuBois said Anthem has and will continue to process and pay claims as quickly and efficiently as possible and “in accordance with the contractual agreements we have with our care provider partners.”

The company’s response misses the point, Ahnen said.

“Anthem may not like the report that was released yesterday, but it doesn’t change the fact that hospitals across New Hampshire continue to struggle to get their bills processed by Anthem,” he said.

Disagreement over unpaid claims

The nearly $300 million hospitals allege Anthem owes them in unpaid medical claims is a chief complaint.

In May 2021, when the association began investigating hospitals’ concerns, Anthem had not paid $290 million in claims, the report said. At one point, that rose to $347 million. In January it dropped to $298.3 million.

State law requires that “clean” claims, meaning claims that have not been challenged and are complete when filed, must be paid within 30 days if submitted by paper and within 15 days if submitted electronically.

The report said 57 percent of unpaid claims are more than 30 days overdue. About a third of those claims were more than 90 days overdue, according to the report. DuBois said a large portion of those bills are unpaid because they remain in dispute. She did not say how many or what percentage of those unpaid claims are in dispute.

“Anthem Blue Cross and Blue Shield strives to process and pay claims as quickly and efficiently as possible and in accordance with the contractual agreements we have with our care provider partners,” DuBois said in her email.

Ahnen said when hospitals were in a similar situation with the Veterans Administration a few years ago, administration officials met with each hospital and reviewed every claim. It improved the way it handles claims.

“We no longer have those issues,” he said. “If the VA can do that, a company the size and scale of Anthem Blue Cross Blue Shield should be able to do the same.”

Long waits and conflicting information

Providers – and one entire medical practice – that have been in Anthem’s network for years are suddenly being listed as out-of-network, a designation that has two consequences, the report said. When a person insured by Anthem searches for an in-network provider, their options will be limited and not include providers who are actually in their network. Anthem then charges patients higher out-of-network prices even though the provider was actually covered by their insurance plan, the report said.

When the problem is brought to Anthem’s attention, it has taken months to resolve it, according to the report. That’s a drain on staff time that’s already in short supply, said Scott Sloane, Concord Hospital’s chief financial officer.

“They are hard to reach. They use three different systems for authorizations for services,” he said. “I have multiple staff spending hours every day on hold just trying to contact Anthem. This has been extremely frustrating because it takes so long. But the challenge is if you hang up, you start at the back of the queue.”

The report states that Anthem is giving providers contradictory information about what procedures require pre-authorization and taking as much as a month to reconcile the connecting guidance.

Anthem requires providers to seek pre-authorization through Carelon, the online system it uses to manage medical benefits. But Anthem and Carelon have different lists for which procedures require pre-approval, the report said. As a result, the hospitals say Anthem is incorrectly denying claims for lack of pre-authorization when pre-approval wasn’t required.

Hospitals raised this issue in nearly every workgroup meeting with Anthem, but it continues, according to the report.

“It is utterly confounding that Anthem is unable to resolve a mismatch between their own systems,” the report said.

DuBois did not respond when asked to comment on conflicting pre-authorization guidance.

The New Hampshire Hospital Association alleges the state’s hospitals are victims of Anthem’s “broken” process for handling medical claims. (Screenshot, New Hampshire Hospital Association)

The online portal providers must use to submit claims, Availity, is equally flawed, according to the report. Paperwork must be resubmitted multiple times because Anthem and Availity cannot track documents or resolve conflicting information.

Hospitals hit more hurdles when they try to reach a company representative or use Availity’s secure messaging system. Both can consume hours of staff time, the report said.

“Chat messages are frequently unresponsive, circular, or connected to an entirely different claim because the Anthem representative is responding to multiple chats at the same time,” the report said.

DuBois did not respond when asked about the claim submission portal but said Anthem continues to work with providers to resolve their concerns.

“Anthem, like many other employers including hospitals and care providers across the country, experienced staffing impacts during the pandemic, which compounded workflow challenges, and we have since made significant progress in addressing these challenges,” she said. “Again, there are a number of exaggerations in this report that do not accurately portray our relationships with the hospitals. We have regular calls with the hospitals to review issues when they arise, and these calls lead to constructive conversations.”

This story is courtesy of NH Bulletin under creative commons license. No changes have been made to the article.

Current Issue - April 2024

Current Issue - April 2024