A Geophysical Survey Systems product is used to measure pavement compaction. Courtesy photo.

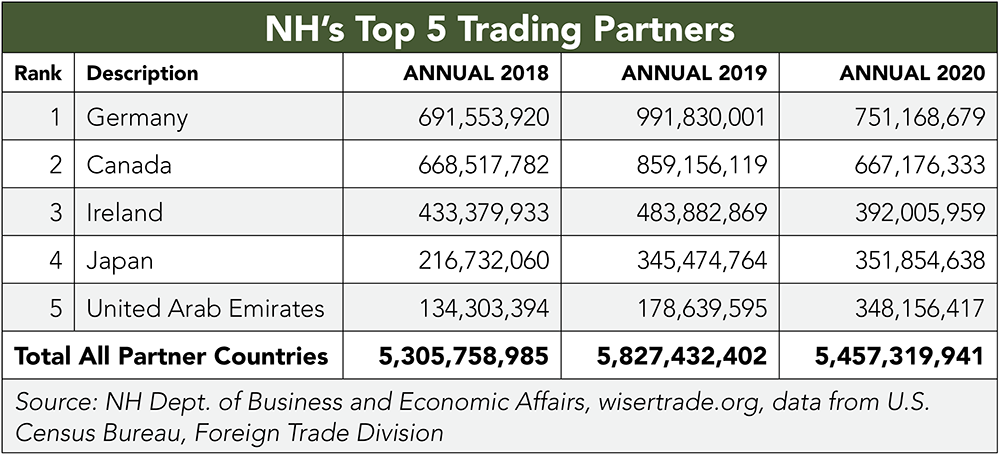

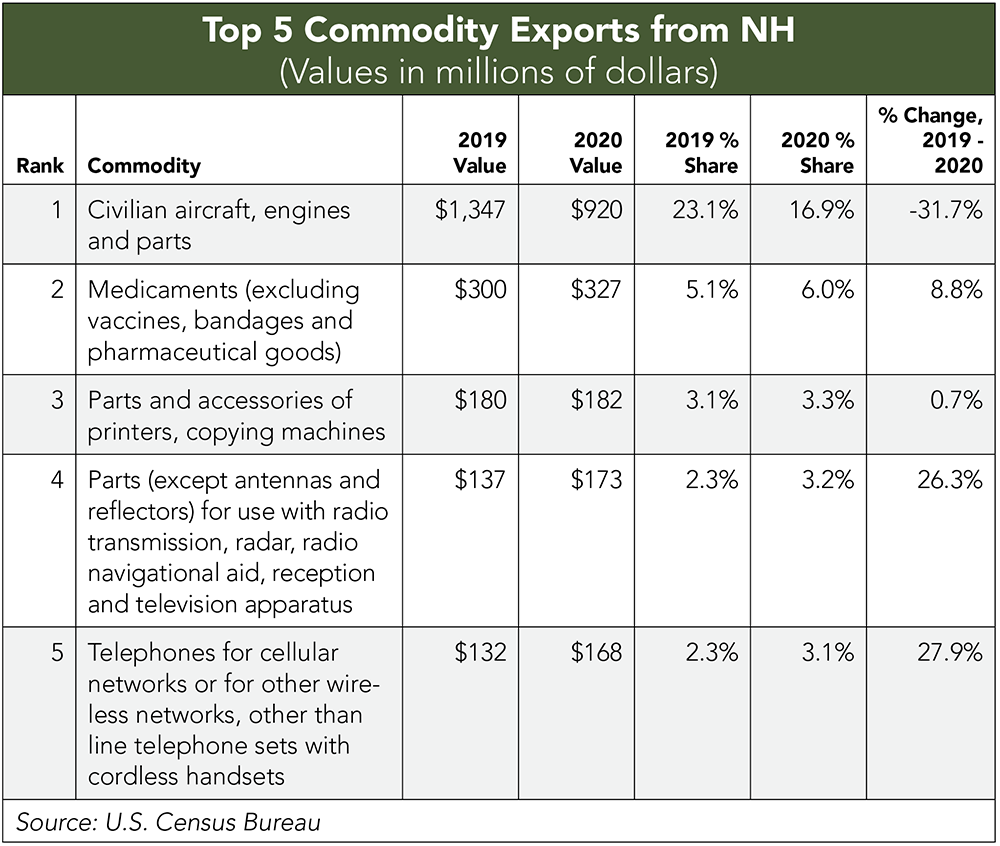

After years of consecutive and robust growth, NH’s exports plummeted by $370 million in 2020 when the pandemic hit and disrupted, well, everything. The effects of the lingering trade war as well as shipping and supply chain issues certainly didn’t help.

Still, the 5.2% decline in NH exports is better than the national average of 6.5% and companies exporting to multiple locations may have fared better than those reliant on a single market as COVID-related shutdowns were stricter in some regions than others.

New Hampshire’s top trading partners have also shifted with Japan and United Arab Emirates moving into the top five while Mexico and China dropped down to fifth and sixth place, respectively.

United Arab Emirates (UAE) is one of the largest markets for NH in the Middle East, and Qatar is growing, according to Tina Kasim, deputy director of the NH Department of Business and Economic Affairs (BEA). UAE is a gateway to the region and other nearby parts of the world and a good transit point for India and other parts of Asia, she says, adding, “It is likely that those products are counted as exports to the UAE but may be going on to other markets.”

Finding Market Opportunities

Geophysical Survey Systems Inc. (GSSI) in Nashua, which makes scientific and industrial instrumentation, has customers on all seven continents, says Christopher Hawekotte, president and CEO. “About half of our business is from outside the U.S.,” he says. “We sell all over the world. Our largest markets, outside the U.S., are China, Japan, France, Korea, Germany and the UK. We were recognized by the U.S. Department of Commerce for growth in exports.”

When the tariffs went into effect a few years ago, GSSI saw some price pressure with the increased costs of importing into China, says Hawekotte. “We were able to deal with that, but the longer those tariffs and the trade tensions go on, the more pressure there is inside China to source alternatives either domestically or products made in countries other than the U.S. We are starting to see and hear more often that being a U.S. manufacturer is a disadvantage in China. Historically, the Chinese viewed American goods as higher quality and more desirable,” he says.

COVID’s effect on GSSI was less than it might have been because many of its customers in the U.S. are essential businesses. “Domestic business has sustained us through the pandemic, but in other countries, especially where they had strict lockdowns and shutdowns, such as Europe and Asia, we have seen demand drop, but things are starting to loosen up in Germany, the UK and Japan,” Hawekotte says.

“In terms of growth, a lot of GSSI products are used in infrastructure assessments and a lot of governments are planning investment in those areas, so we are seeing increased demand in the more developed nations, especially for products that are helping to address infrastructure,” says Hawekotte.

A product that allows paving companies to measure compaction of the pavement more accurately is helping to make more efficient use of public funds for roadways, says Hawekotte. “We are seeing significant growth in that area, both in the U.S. and in other countries because of all the attention being paid to infrastructure improvements and the condition of bridges around the world.”

Jewell Instruments, a Manchester-based manufacturer of sensors used in industrial applications, experienced a shift in regions to which it exports as well as a shift in the balance of business done domestically versus overseas, says Brian Ward, vice president of sales and marketing.

An employee assembling a sensor at Jewell Instruments. Courtesy photo.

“We do business in the regions of the Americas, EMEA [Europe, the Middle East and Africa] and the Pacific Rim,” says Ward. “We have always been 55% Americas and 45% international in the sensors and control group, and 2019 we were starting to get to 50/50, but in the COVID period of 2020, we went the other way to almost 40% domestic, 60% international.”

Ward says a lot of the change was from the European side because it’s a key market in rail transportation. “Our sensors are in metro trains all over the world, and that side of the business was affected by COVID as projects were delayed. But our industrial markets went up. So, it was a good thing for us to have so much of our market in the international arena,” he says.

Like GSSI, the increased focus on infrastructure improvement, including the recent passage of the Infrastructure Investment and Jobs Act, may create new opportunities for Jewell, with freight train systems in need of modernization and safety improvements.

“Our accelerometers are used in CBTC, which is communications-based-train-control systems. The sensors are in the front and rear of each train, and used for acceleration and deceleration or the train going in and out of the station as well as positioning of the trains on the tracks,” Ward says. “The freight side is more legacy, old school, but governments are starting to look at more automation there as well.”

Supply Chain Holding Back Businesses

The global disruption in the supply chain is being felt by NH companies. “Supply chain is the biggest challenge right now, getting the parts and components we need to build products” says Hawekotte. “It is a challenge and a drag on business, and we are expecting it to continue for another six months at least.”

Hawekotte says lead time for some components went from a few weeks to 52 weeks or longer. That has led to some panic buying as people hoard some materials, making it worse. “That is the biggest thing impacting GSSI and other firms in terms of being able to capitalize on a growing economy.”

Kasim says NH businesses that rely on items that traditionally come from overseas that are being held up or are in limited production, are looking to source elsewhere. “There are delays in shipments and increased costs in shipping,” she adds. “The planning side of it has people working well in advance, being cautious with estimates and adding on for shipping. It is definitely a tough time requiring a lot more coordination.”

Export Resources

One of the ways the BEA helps businesses is through the Office of International Commerce State Trade Expansion program (STEP) funded by the U.S. Small Business Administration. Co-authored by U.S. Sen. Jeanne Shaheen, and now in its 10th year, STEP is a competitive federal grant to support export activity.

“New Hampshire has been fortunate to receive an award each year,” says Kasim. “It says something about the way [the state] runs the program and its value to our exporters. Those results, year over year, increase our competitiveness.”

Through STEP, small to medium-sized businesses find new markets, get up to speed on export compliance, and learn how to market internationally, vet companies and understand the cultures of the countries where they want to do business. “Is it the right market for your product? Is it the right time and place?” asks Kasim. “If not, we just saved the firm a lot of time and money. Then they can re-focus and look at other opportunities.”

Many states have offices in international markets, but not NH. So, the BEA works closely with the U.S. Department of Commerce’s Commercial Service Office, which has offices in U.S. embassies all over the world. “Once we have a company that is ready to go international, they are the arm that allows us to do that. They do a fabulous job,” Kasim says.

Others that support exporters include the Small Business Development Center, Manufacturing Extension Partnership, NH Aerospace and Defense Export Consortium, and the Granite State District Export Council. “All these entities have an impact in getting a business to the point where they are ready to export,” Kasim says.

Current Issue - May 2024

Current Issue - May 2024