Insurance is all about risk protection. And the last two years have driven demand for insurance products as businesses seek assurance in a world filled with uncertainty. However, risk protection is coming at a higher cost, say insurance experts, who are predicting that premiums for commercial lines will increase, on average, 10% to 11% in 2022.

“The factors driving these rate increases show no signs of waning,” wrote economists for Leaders Choice Insurance in a recent blog post. “There are a number of factors affecting rates, and they vary depending on where a business is located as well as the industry in which it operates.”

Natural disasters are becoming more frequent and more severe in many parts of the country. Rebuilding costs are higher due to inflation and labor shortages.

Cybercrime has emerged as a major cost driver. Lawsuits over employment practices have become more frequent, and juries have been handing down larger awards. Motor vehicle accidents, after decades of decline, have been rising again for the past two years. Medical costs are higher for accident victims, as are repair costs for damaged vehicles.

Add to all that the fact that many insurance companies lost money last year, primarily on natural disaster and cybercrime claims, and that money has to be recouped in some fashion.

The only bright spot, in NH at least, is workers’ compensation. Those rates have been declining in recent years as manufacturing jobs left the state or were automated, people began working from home more and workplace safety practices improved.

Given the rising costs, it’s important for business owners to take stock of their current insurance portfolio to ensure adequate coverage. “The most important thing to do is to sit down with your broker and really explain in detail what your company does. Make sure it’s understood and not just assumed,” says Keith Bouvier, a commercial lines group producer with Core Insurance of Hampstead. “It’s not that we’re going to tell people they should have less insurance. That’s just not the way of the world. But if they are budgeting a 10% increase, in most cases they are going to be OK.”

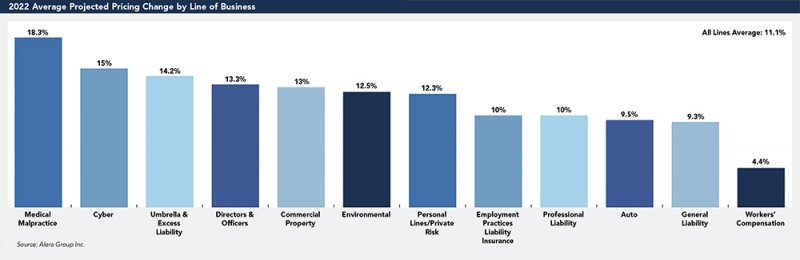

Here’s a look at the rate hikes projected by Alera Group in the key lines of commercial insurance, starting with the biggest increases.

Cybercrime

Insurance companies have not been charging enough for this kind of coverage based on the claims they’ve had to pay and are determined to close the gap. These rates are projected to rise 15% or more, with little or no variation based on geography.

“Cyber insurers are seeing their expenditures, as a proportion of premiums paid, surpass 70%. It should be no surprise that cyber insurance premiums are on the rise,” states the National Association of Insurance Commissioners in an Oct. 20, 2021 report on the cybersecurity market. “A recent survey of brokers shows an increase of 10–30% in cyber insurance prices during the last quarter of 2020. “Additionally, the survey indicated the increased pricing trend continued in the first quarter of 2021, as renewal pricing on cyber insurance rose by an average of 18%. However, even as prices rise, demand has grown for cyber insurance in the second quarter of 2021. These price increases are likely to be seen in the 2022 version of this report,” the Association’s cybersecurity report states.

This kind of coverage was once commonly added as a rider or endorsement to a general liability or excess liability policy, but no longer. “We recommend a separate cybercrime policy with a company that specializes in cyber liability,” says Chuck Hamlin, commercial lines department manager with Davis and Towle Insurance Group in Concord. “This is the area we’ve seen the biggest change because of the increase in the cyber type of attacks.”

As a condition of coverage, insurance companies are requiring customers to up their game when it comes to security, with measures like dual-factor or even multi-factor authentication (MFA) required for log-ins.

“We’re seeing companies who’ve had cyber coverage in the past but don’t have MFA being told they will not have their policy renewed without that piece in their security,” says Hamlin.

Umbrella & Excess Liability

These policies cover losses that exceed the limits of the primary insurance policy, usually known as general liability. Rates here are projected to rise as much as 15% based on the rising cost of litigation, greater frequency of lawsuits and large jury awards. The median verdict for the top 50 cases has doubled in the past four years, according to Global Insurance Broker A.J. Gallagher.

Directors and Officers

Premiums are projected to rise 10% to 13% on these policies that protect board members and senior executives. “People are holding directors and officers more accountable than in the past,” says Rob Simpson, vice president with the Rowley Agency in Concord. “In a lot of cases, the directors and officers may not be responsible for what happened, but they still have to defend themselves.”

Commercial Property

“You have a building; you have property; something happens. Even just to repair the property is significantly more expensive than it was two years ago, if you can find someone to do it,” says Bouvier.

The skyrocketing cost of repairs comes at a time of increasing natural disasters. “Anyone can see the news reports about these things being more common and more catastrophic,” Bouvier adds.

New Hampshire and New England as a whole have, so far, been in the lucky geography club when it comes to natural disasters and so will not face the same rate hikes as harder hit states. “The increases we’ve seen have been mainly due to the cost of rebuilding,” says Bouvier. Rate increases in NH for this type of coverage are likely to be slightly below the national average of 13%.

Employment Practices Liability

“This is something that’s been overlooked in some places and I think now it’s more important than ever,” says Bouvier. “Not only is the cost up 10% or more, but we’re seeing tighter underwriting guidelines.”

Workers have less trepidation about leaving a job or suing their boss these days. Lawsuits over age discrimination, unlawful discharge, sexual harassment or retaliation have been on the rise for years, and whether settled by mediation or litigation, the costs can be exorbitant.

The best way to keep rates down is to “start with the basics,” says Bouvier, “like a handbook, a code of ethics and open lines of communication.” Keeping in touch with remote employees has taken on new significance, he adds.

Commercial Auto

While expected to rise about 9.5% on average, this is one area where it’s hard to make a general statement about rates because policies are built largely around driving records and claims experience, much like a personal auto policy.

But no matter how good your company’s record, everyone who’s insured shares the cost of more accidents and injury. “The distracted driving is a big problem, and it’s just as severe on the commercial side as the private side,” says Simpson.

Bouvier recommends modern tracking technology. “You can get devices that record information off the vehicle and give you metrics like fast stops, or how fast the driver speeds up, because it’s linked to the GPS. A lot of employees don’t want to feel like they’re being watched, but it’s about training, getting them to take a step back and drive a little better.”

Workers’ Compensation

Although projected to rise 4.4% nationally, these rates will likely continue a downward trend or remain flat in NH. “Safety management across the board is key,” says Simpson. “All the insurance companies have loss-control people who will go out and meet with the client on what they do and how they do it, and they will give them recommendations on how to mitigate future loss.”

The insurance landscape has changed so significantly in recent years and every business would be wise to review their coverage, make sure it’s adequate and decide which policies can be bundled and which should stand alone.

“We’re selling an intangible. But when you need it, you need it,” says Simpson.

Current Issue - July 2024

Current Issue - July 2024