Among the trends to watch in NH’s rising commercial real estate market is mixed-use properties—combining office, retail and housing—as well as more owner-occupied office buildings.

“Market demand for industrial and office space reflects the growth of the local and U.S. economy, which is the best we have seen for many years, and therefore I see the market continuing to grow,” says Michael Bergeron, senior business development manager for the NH Division of Economic Development. “I think there’s going to be continued growth and fantastic opportunities for companies.”

The state has not seen the skyrocketing commercial growth of markets like Boston with “a whole skyline full of cranes,” but it has experienced significant growth over the last several years, says Tom Farrelly, executive director of the NH brokerage team at Cushman & Wakefield in Manchester.

Vacancy rates for industrial space in southern NH are less than half what they were in 2014 and now stand at about 8.2 percent, according to Cushman & Wakefield research. Office availability is also down slightly, but varies dramatically by community, with vacancy rates ranging from 27 percent in Concord to a low of 3 percent in Portsmouth.

While southern NH has far more activity because of its proximity to the Boston market, many North Country communities are also seeing industrial growth, according to Bergeron, who points to Capone Iron Works and Deflex Composite locating to Berlin and NSA Industries moving to Groveton, all leasing existing space within the past two years and many with plans to expand.

Meanwhile, biotech is strong not only in southern NH but also Lebanon, home to Dartmouth-Hitchcock Medical Center, according to Bergeron. Heavy industrial is growing in Dover, Rochester, Littleton, Berlin, Groveton, Colebrook and Laconia, he adds, while logistics are strong in Londonderry, Seabrook, Keene and Littleton.

With tightening vacancy rates, commercial construction is also enjoying an uptick, according to Joshua Reap, new president of Associated Builders and Contractors NH & Vermont Chapter. “There is a significant need for commercial and industrial space,” says Reap. “We keep track of the construction backlog indicator, a metric that judges how much work is on the books waiting to be scheduled to start. In New Hampshire, it’s the longest on record, 10.2 months.” He could not say how many projects that backlog represents.

Rents Remain Steady

Despite low vacancy rates in some areas of the state, rents have not significantly increased, with office space in southern NH renting for under $17.50 per square foot for the last three years compared to $18.01 in 2014. Manchester and Portsmouth are slightly higher at $19.01 and $19.68 respectively.

“Rents have increased, but not to a great degree,” says Bergeron, who points out that office rents in downtown Boston can be as high as $65 to $75 per square foot.

Industrial NNN (or net-net-net) asking prices, which include added expenses like real estate taxes, common area charges and some utilities, are likewise flat, at $5.79, compared to $5.72 in 2014. “While many landlords are encouraged, some remember the pain of carrying empty space and have not been overconfident on rents in pursuit of tenants even though space is filling,” says Farrelly.

Hot Spots

That may change as projects like the I-93 widening contribute to commercial growth in the southern part of the state. “You’re seeing new office construction at Exit 2 in Salem,” notes Roger Dieker, first vice president of the Manchester office of CBRE/New England’s Southern NH Brokerage team. “The office market there is probably second only to Portsmouth.”

The I-93 corridor is also where much of the commercial construction is underway or planned, says Reap. “There’s a reason they’re widening that road,” he says. “All along the sides, you have industrial parks that are growing, which leads to more hotels and academic institutions. You still have construction in the north area and the Lakes Region, but nothing like in the south.”

Other areas of the state are seeing commercial growth for different reasons.

“Manchester is the largest commercial center in the state and it has, over the past 10 years, kind of lagged,” says Dieker, but that is starting to change. “It’s tight in the industrial park, you’re seeing rates rise and you’re seeing a lot of new construction out by the airport and that’s all positive.”

The commercial market is especially tight in Portsmouth, as “there is very little buildable land left,” he adds.

In Concord, “you’ve still got a lot of office that’s having trouble,” says Dieker. “A lot of state offices were vacated, and they’re having trouble backfilling. But on the industrial side, Concord is a little tighter than it has been over the past few years.”

Nashua, the state’s second largest city, has its own dynamics, he says. “It has a huge industrial and office market,” he explains. “Part of the reason why you still have some moderate vacancy there is you have so much capacity.”

Skewed Figures

A few hard-to-move properties have colored the statistics in some communities, experts say. “You’ve got some one-off buildings that skew the data,” says Dieker. “One building in Bedford, for example, at 150,000 square feet, has been vacant for years, and it skews the Bedford industrial market.” Another two-story industrial building on Iron Horse Drive in Nashua hasn’t been functional for some time and affects that city’s data, he adds.

Farrelly points to a 175,000-square-foot building on Simon Street in Nashua that sat vacant for years before owners tore down part of the building for parking.

Give Me Shelter

But business activity isn’t the only thing driving NH’s real estate market. “Commercial would also include apartment buildings, and that has been one area where there has been strong activity in construction of multi-family properties, apartments and condos,” says Farrelly. “The other is hotels. You’ve seen a prolonged, strong market for both apartments and hotels.”

Dieker, too, notes a surge in multi-family units. “The millyard in Manchester has been very successful in converting a lot of those [buildings] to residential and the Citizens Bank building in Manchester was successfully converted to apartments,” he says.

Shifting Trends

Farrelly, who opened the NH office for Cushman & Wakefield 32 years ago, says cycles aren’t as predictable as they were years ago. “We’re intrinsically linked to Boston, so in the past, when vacancy went down, rentals went up, and high rents and scarcity of space usually drove companies to the suburbs, and that drove companies in the suburbs to consider options like moving to New Hampshire,” he says. “You could almost set your watch to it.”

Now, he says, “There are a lot of new trends in the way people occupy space.… It seems like in the new millennial-driven way of thinking, companies are gravitating more to urban than suburban. Companies are not making decisions purely on availability and pricing of space. It’s all about creating the ideal environment to attract the ever-shrinking availability of workers, using your workplace as a platform for recruiting.” He cites as an example the Fort Point Channel area of Boston, an old industrial area of several hundred acres that became a revitalization success story after biotech companies started moving in.

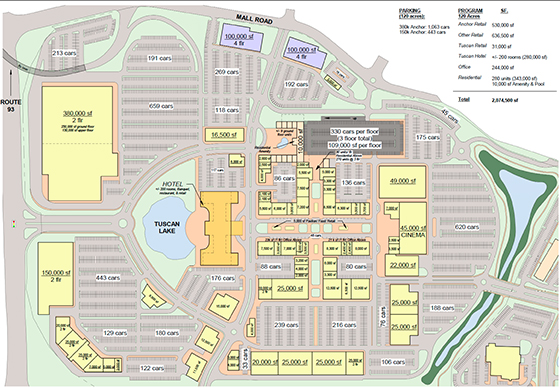

Mixed-use developments may be another up-and-coming market. Dieker points to Salem’s Tuscan Village, whose plans include retail, grocery, hotel and residential units slated for construction in 2018, as one example, as well as the Market and Main project now under construction at the former Macy’s site in Bedford, which will include mixed-use retail, a movie theater and a parking garage.

Renderings of the proposed Tuscan Village in Salem. Courtesy of Cushman & Wakefield

Farrelly, too, notes that Tuscan Village “seems to be exceedingly well received by the market” and lists other projects in the mixed-use model, such as Woodmont Commons in Londonderry, a 600-acre development to include retail, hotel, assisted living and residential near the proposed Exit 4A off Interstate 93. “And if you look at Exit 10 in Merrimack, there are aggressive plans for more retail, office and apartments,” he adds.

Woodmont Commons in Londonderry.

The future may also see more companies buying, rather than leasing, their buildings. “A lot of office users have stepped up and acquired office buildings,” taking advantage of low interest rates, says Dieker, citing the Mental Health Center of Greater Manchester purchasing its building on Wall Street as an example. “Owner-occupied buyers are buying properties [for] under replacement costs,” he adds. “An older building that may have some life left, you could purchase under replacement cost.”

Part of the reason that’s true is because of rising construction costs—one of the challenges NH’s commercial real estate market still faces. Reap says the costs of construction have risen 5 percent in the last year, owing to the cost of inputs, petroleum and, especially, a shortage of skilled labor.

Overall, though, most analysts see nothing but growth in the immediate future for NH’s real estate market. Barring some external shock, Cushman & Wakefield’s 2017 Q3 report concludes, “We expect the Southern New Hampshire commercial real estate market to remain solid.”

Current Issue - May 2024

Current Issue - May 2024