An employee at Avitide in Lebanon. Courtesy photo.

In 2001, when Phil Ferneau and his partners were launching a venture capital firm focused on NH startups, they met with several academics at Dartmouth College. Ferneau had been an advocate for converting academic research into viable companies in his role as founding executive director of the Center for Private Equity and Entrepreneurship at Dartmouth’s Tuck School of Business.

As he and his associates launched Borealis Ventures, one of their first tasks was to convince the college leadership that developing new businesses was a proper role for an esteemed institution of higher education. Ferneau recalls, “This one senior college official said, ‘I understand you’re excited about the idea of starting new companies. But I think we have all the companies around here that we need.’ And that was the parochial academic village approach to innovation.”

From left: Emily Snyder, principal, Borealis Ventures; Phil Ferneau, co-founder and managing partner, Borealis Ventures; and Kevin Isett, CEO of Avitide. Courtesy photo.

From left: Emily Snyder, principal, Borealis Ventures; Phil Ferneau, co-founder and managing partner, Borealis Ventures; and Kevin Isett, CEO of Avitide. Courtesy photo.

In the 20 years since, Dartmouth has embraced its role in laying the foundation for a cluster of bio-medical businesses that now attract global attention with their effect on health sciences. The Hanover-Lebanon area, known as the Upper Valley, has emerged as a research and entrepreneurial hub that punches well above its weight class and competes with places like Cambridge and San Francisco.

While the presence of Dartmouth in the Upper Valley has everything to do with why the hub emerged there, other pieces had to fall in place over the past two decades. “First was the background acceptance of entrepreneurship as a good thing, and that took years to build,” says Ferneau. “Then you need case studies and role models.”

The 20-year history of biotech’s growth in the Upper Valley is in large part the story of researchers at the university, venture capitalists from firms like Borealis and inspired entrepreneurs, whom Ferneau calls “Pillars of the Ecosystem.” Those “pillars” include Jake Reder, founder of Celdara, a company that turns academic medical research into FDA-approved therapies that can be brought to market. But the most influential pillar is Dartmouth professor and bioengineering entrepreneur Tillman Gerngross.

The Acorn That Took Root

Gerngross, along with former Dartmouth Dean Charles Hutchinson, launched a company called GlycoFi in 2000. They wanted to create a better way to produce protein-based drugs, which were becoming prevalent at the time, but manufacturing was a challenge and expensive. They found a better way to do it; raised venture capital; and built a company in Lebanon that was acquired by Merck in 2006 for $400 million.

Dartmouth professor and entrepreneur, Tillman Gerngross. Courtesy photo.

Dartmouth professor and entrepreneur, Tillman Gerngross. Courtesy photo.

“That was a big wake-up call for a lot of people, because it showed a few things,” says Ferneau. “First, a biotech company could be built in the Upper Valley. It could attract venture capital in the Upper Valley. And it could attract the interest of major pharmaceutical companies.”

GlycoFi set up shop in Hanover’s Centrerra Business Park, which Dartmouth developed in the late 1990s after Mary Hitchcock Memorial Hospital moved from Hanover to the Route 120 corridor in Lebanon.

The existence of adequate space and proper facilities to launch a life-science operation also played a huge role in the emergence of the hub. “It’s a good thing Centrerra was there,” says Ferneau, “or you couldn’t have built a lab-based business. Now it’s home to Adimab and other companies.”

GlycoFi was the acorn that took root in the business park. Nurtured by an increasingly supportive academic community, its success led to other successful biotech launches.

After GlycoFi was acquired, Gerngross cofounded Adimab with Dane Wittrup, a professor at MIT, with many of the same investors as GlycoFi. Twelve years after its founding, the company is still in the Upper Valley and is the world’s leading developer of antibodies for pharma and biotech companies.

Taking It to the Next Level

Adimab continues to spin off other companies, like Adagio Therapeutics, another firm working on therapeutic antibodies now in much demand due to COVID. Adagio, now located in Waltham, Mass., went public last month and was valued at more than $5 billion.

“The world really changed in the Upper Valley from before GlycoFi to after GlycoFi,” says Ferneau, “and Adimab took it to the next level.”

Gerngross has continued to launch successful biotech firms, including Avitide, which he co-founded with CEO Kevin Isett and Chief Scientific Officer Warren Kett in 2013. The company developed a better way to purify biologic drugs, and in September was purchased by global bioprocessing vendor Repligen for $150 million.

“His fingerprints are on a lot of these companies,” says Ferneau. “It’s not just what he does by himself, but also how he inspires other people.”

Gerngross’ other major contribution to the growth of both high-tech and bio-tech businesses in the Upper Valley is his role in the development of an intellectual property transfer policy at Dartmouth that is generous to the inventors. Under the policy promoted by Gerngross, Dartmouth takes only 4% of the equity in companies launched by Dartmouth faculty and students working at college facilities. “The intellectual property transfer function has often been contentious at universities generally,” says Ferneau. “Instead of treating it as zero-sum game where the college negotiates against its own faculty for licenses to the founder’s technology, why not flip the table and make it founder-friendly, with the goal of attracting the most innovative faculty to Dartmouth?”

From Research to Market

Another Dartmouth spinoff is Celdara Medical. Jake Reder, who had been with the Geisel School of Medicine at Dartmouth, co-founded the company in 2008 with Professor Michael Fanger to convert the work of inventors into successful enterprises.

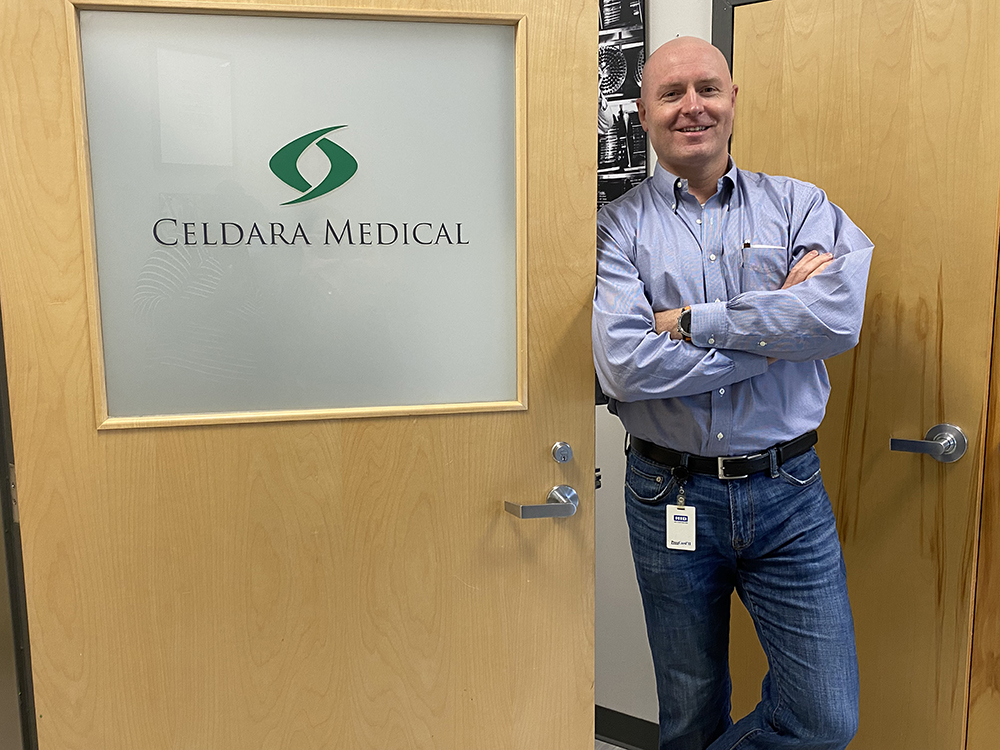

Jake Reder, co-founder of Celdara Medical. Courtesy photo.

Jake Reder, co-founder of Celdara Medical. Courtesy photo.

The National Institutes of Health took notice of Celdara’s work in the Upper Valley and asked the company to send a delegation to Washington, D.C. The result was a three-year, $3.5 million Accelerator Hub Award from the NIH in 2018 to Celdara and the University of Vermont to promote medical innovation and entrepreneurship in the Northeast.

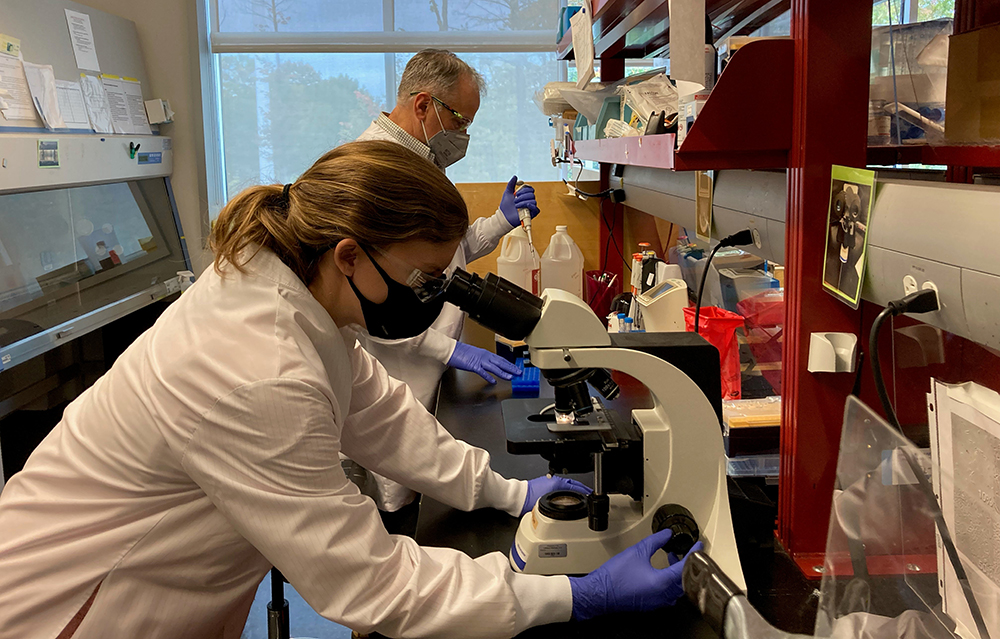

Below: Employees working in the lab at Celdara Medical. Courtesy photo.

Below: Employees working in the lab at Celdara Medical. Courtesy photo.

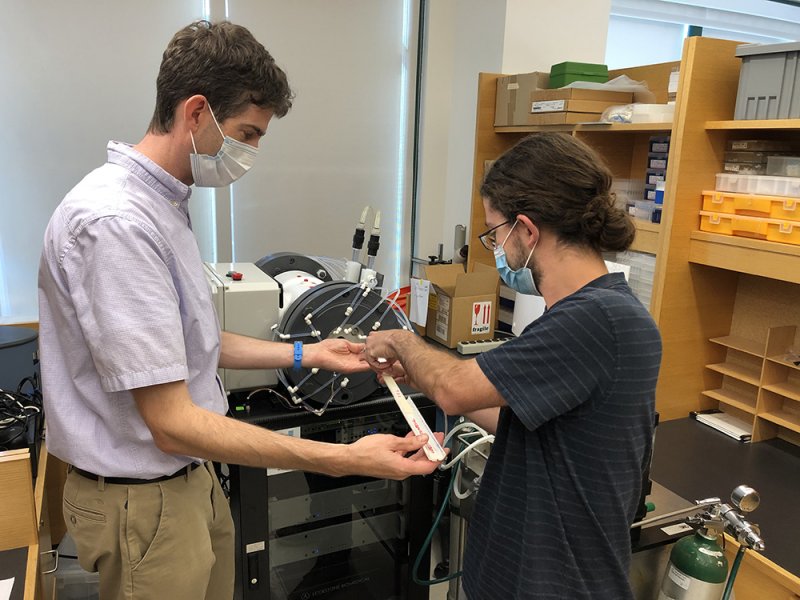

That work has helped advance 14 startups in the past three years, with six in the Upper Valley: Arctic AI, working to improve biopsy analysis; CairnSurgical, developing 3-D printed surgical guides; Clairways, which improves clinical trials for new drugs treating chronic respiratory disease; Episteme Prognostics, a diagnostic test used in cancer treatment; Javelin Oncology, which is advancing precision oncology; and Lodestone Biomedical, developing biosensors used in cancer treatment.

CairnSurgical founders Keith Paulsen, Venkat Krishnaswamy and Richard Barth. Courtesy photo.

Tracey Hutchins, president and CEO of the Upper Valley Business Alliance, points to the recent creation of the Upper Valley MedTech Collaborative as the latest initiative designed to keep the hub humming. Founded in 2020, the collaborative serves as a sort of chamber of commerce dedicated to the med-tech community, providing networking and education events.

A Lodestone system at Dartmouth-Hitchcock Medical Center.

A Lodestone system at Dartmouth-Hitchcock Medical Center.

The organization came out of discussions at Simbex, a Lebanon-based medical device company launched in 2000. “There is so much going on in the way of medical technology in this region,” says Hutchins, “but the different small companies don’t necessarily know what each other is doing.”

“When you have an educational institution like Dartmouth [College] and the Geisel School of Medicine, the Tuck School of Business, Thayer School of Engineering and Dartmouth-Hitchcock, which is a leading teaching hospital, and it’s all located right here, that creates a really good environment,” she says. “When you put all those elements together, you get this creative soup of an environment to nurture innovation, and that’s exactly what’s happening here with medical technology.”

A Lodestone system at Dartmouth-Hitchcock Medical Center. Courtesy of Lodestone.

One possible challenge, however, is a workforce shortage, says Julie Demers, executive director of the NH Tech Alliance.

“The jobs are very desirable, but the problem is the ratio of vacancies to the qualified people available to fill them,” she says.

“We surveyed our members recently and asked what they were most concerned about, and without exception, the number one issue was recruiting and retaining workforce, and that was across all sectors, including biotech.”