With vaccine distribution underway, a smaller than anticipated budget shortfall and unemployment levels returning to near pre-pandemic levels, Gov. Chris Sununu is optimistic about the future of the Granite State. However, as he enters his third term, Sununu says NH still faces several challenges related to COVID-19, and it will remain the top priority.

“We’re still going to have COVID here for quite some time. We could see another surge in the spring. We’re in a second surge now,” says Sununu during an interview in mid-December. “My guess is we’re going to have a third surge in the spring, but again, hopefully by then, the highest risk individuals will have had access to the vaccine.”

In addressing the pandemic, NH found a balance that very few states struck, says Sununu. “I think early on we knew that the economic crisis could be just as bad as the COVID crisis because of the negative health effects of isolation, mental health, lack of education. All of these things are really negative effects on a very different population than COVID was affecting, which was primarily the elderly in long-term care.”

While the state saw tremendous losses in revenue early in the pandemic with the closure of restaurants, other tax income went up including tobacco and liquor sales. With fewer people taking to the skies for plane trips, regional tourism boomed, and shortfalls were far below the early dire predictions.

“We’ve managed, frankly, really well” Sununu says. “Our team has done a phenomenal job over the past year in making what we thought could be a $500 million problem to about a $60 million problem. That’s very manageable out of a $13 billion budget. We don’t need to look for more revenue and raise taxes.”

He says managing conflicting demands was difficult as some did not want to shut anything down and others wanted to shut it all down. “I appreciate both those arguments. There’s validity to both sides, but we just are going to walk this balanced path and do what we know is right based on data, and we got it right. We had to write the playbook as we went along, but I had a great team around me,” Sununu says.

And voters agreed as Sununu handily won re-election in November. While his endorsements did not carry enough weight at the federal level (where Democrats dominated NH’s election), Sununu’s coattails proved long at the state level as NH became the only state to flip party control, with Republicans winning majorities at the State House, Senate and Executive Council. And while Sununu set a state record for the number of vetoes in a single year in 2020 (more than 20), the elections place him in a position to push through his agenda rather than play defense.

Still Sununu is not assuming 2021 will be easy. He notes that after the initial round of CARES Act money, states were told more federal aid would be coming. But, he says, Washington just closed up, and Congress couldn’t agree on anything.

“They let politics get in the way; that was very frustrating. Congressmen and senators don’t have the responsibility of managing and operationalizing the opportunities. The financial assistance they gave us was terrific, but they don’t have that responsibility of really interacting with the businesses, individuals and schools that were being most impacted. So, when they said we’re going to do more and didn’t … that was obviously a very big letdown.”

Sununu says the state cannot afford to put politics first in decision making. “Anytime you put politics as a variable in your decisions, it never works out right. When you allow that to happen, you’re sacrificing something.”

Critical Budget Season

As the governor prepares to kick off the state budget process, many questions remain, including whether that additional federal help will come. Sununu expects to complete his budget by the end of January and present it in the first or second week of February.

If Congress passes additional relief by January, Sununu says he will be able to factor it into his budget and would likely place relief funds within the Governor’s Office for Emergency Relief and Recovery (GOFERR) to be deployed quickly. Early in the pandemic Democrats criticized the governor for not obtaining Fiscal Committee approval from the legislature for federal COVID-19 relief funds and unsuccessfully sued. In an apparent nod to ruffling those feathers, Sununu says he wants the legislature to have as much say as possible in future stimulus responses, including funds for infrastructure projects and job or economic initiatives related to the pandemic, as long as it does not limit the state’s ability to react to the crisis.

While other states scramble to cover huge deficits resulting from the pandemic, Sununu believes NH is in a position to lower taxes. “Our whole budget will be based around a concept of cutting taxes; that’s a big priority for me,” he says, explaining he will propose cuts to the meals and rooms tax and business profits tax and may even attempt reducing the interest and dividends tax.

How is that possible at a time when demand for assistance and services is up and revenue is down? State agencies underspent their budget allocations, which softened the blow of the revenue shortfall, resulting in a preliminary budget deficit of $67 million for FY 2020, according to the NH Fiscal Policy Institute (NHFPI). The revenue projections for FY 2021 suggest the state’s Rainy Day Fund of $115.5 million could substantially offset that budget shortfall, according to NHFPI.

Sununu confirms that if the state does need to backfill funds in the last part of the budget cycle, there’s more than enough in the Rainy Day Fund. However, he notes it took hard work managing expenses in 2020, and 2021 has many unknown factors.

“We need to put more into our Rainy Day Fund. We effectively today have a limit on what we can put into it,” says Sununu.

“That’s weird, I mean the fact that you put a cap on your savings account. Why would you do that; who does that?”

At the very least, it appears businesses dodged a bullet in the form of automatic increases in the Business Profits Tax (BPT) and Business Enterprise Tax (BET), which would have taken effect this month if FY 2020 business tax revenues fell 6% below projections. Unaudited figures show a 5.4% decline, narrowly missing the tax hike trigger.

Many interests will be keeping a close eye on the upcoming budget. Among them is the Business and Industry Association of NH (BIA), a statewide chamber of commerce. Jim Roche, president of the BIA, says the organization is focused on making sure the state budget is constructed in a way that doesn’t adversely affect employers.

“In the private sector, businesses are tightening their belts and looking for ways to improve efficiency; state government needs to do the same thing. Obviously, we would not support any increase in business taxes to cover a [shortfall],” Roche says.

The governor says there are still efficiencies to be found to prevent tax increases while still maintaining a high level of services. He adds that other states, such as Massachusetts, Connecticut, New York and New Jersey, which were hit harder by the pandemic have not been as fortunate, facing potentially billion-dollar deficits.

The governor says there are still efficiencies to be found to prevent tax increases while still maintaining a high level of services. He adds that other states, such as Massachusetts, Connecticut, New York and New Jersey, which were hit harder by the pandemic have not been as fortunate, facing potentially billion-dollar deficits.

“If there are stimulus opportunities, those states are going to have to backfill their revenue,” says Sununu. “We’re going to be creating jobs. I think a lot of folks understand that, which is why you’re seeing so many businesses move into the state right now.”

Taylor Caswell, the commissioner at NH Department of Business and Economic Affairs (BEA), as well as the executive director of GOFERR, says the half billion dollars of CARES Act funding the state quickly disbursed to private businesses helped to increase interest from businesses to move here.

“A lot of companies are looking at how their states treated them during the pandemic, whether it was the types of restrictions that were placed on them, the types of funding or the priorities they put on funding,” Caswell says. “Then they look at New Hampshire, where we placed a heavy emphasis on finding that balance between public health and being able to operate a business.”

Managing Workforce Needs

Amid the concerns of a nationwide economic downturn and a budget shortfall in NH, there is also fear that the state unemployment trust fund might become insolvent, and the burden to replenish the fund could fall on businesses in the form of higher payroll taxes.

Rich Lavers, deputy commissioner of the NH Dept. of Employment Security (NHES), says the state has taken several actions to shore up the fund. The balance of the trust fund as of mid-December was approximately $80 million, says Lavers. An additional $50 million from unspent CARES Act flex funds was deposited into the trust fund.

“Looking at current claim volume and trying to forecast out through 2021 can be difficult as both positive and negative impacts are possible. But with that $50 million, and possibly some additional money coming from the CARES Act, we are looking at being able to stay solvent through 2021 and keep tax rates on employers low,” Lavers says.

The state learned an important lesson in the Great Recession, he says, when rates quintupled for employers and created a disincentive to hire new workers. Because taxes are assessed per worker, “It has the effect of undermining any growth you would like to see in the workforce,” Lavers explains.

When the unemployment rate hit 17% in April, at the peak of the pandemic-driven shutdown, it represented a massive challenge for a state system used to low unemployment. With nearly 30,000 out of work, processing claims was made even more challenging by the additional federal benefit and the lack of clarity around it.

“States were in a tough spot early on with the passage of the CARES Act because there was so much new money. The average New Hampshire benefit had been just over $300 a week and the max just under $430. With the additional $600, the pressure to get it delivered was intense,” says Lavers. “That was the most frustrating piece for states, adapting to a brand-new program, and you still have to get the eligibility right even as the federal government was slow to provide guidance.”

“New Hampshire was ahead of the curve because the governor recommended creating broad eligibility to be able to pay benefits to gig workers, self-employed and others who would not normally be eligible prior to the CARES Act,” says Lavers.

“And that $600 benefit meant there was $850 million going out to New Hampshire workers. It clearly was a big component providing the ability for people to quarantine and abide by stay-at-home orders by removing financial pressures.”

Compared to the national unemployment rate of 6.7%, NH sits among the bottom five states at 3.8%; higher than pre-pandemic levels but low enough that many NH employers are once again struggling to find workers. Lavers says that is why the administration opposed measures in the legislature to extend or make permanent some of the pandemic unemployment policy changes.

“The last thing we want is to make it easier to collect unemployment benefits,” he says. “We opposed both measures because businesses are already struggling. We need to create a clear path for employers to get back to pre-pandemic conditions.”

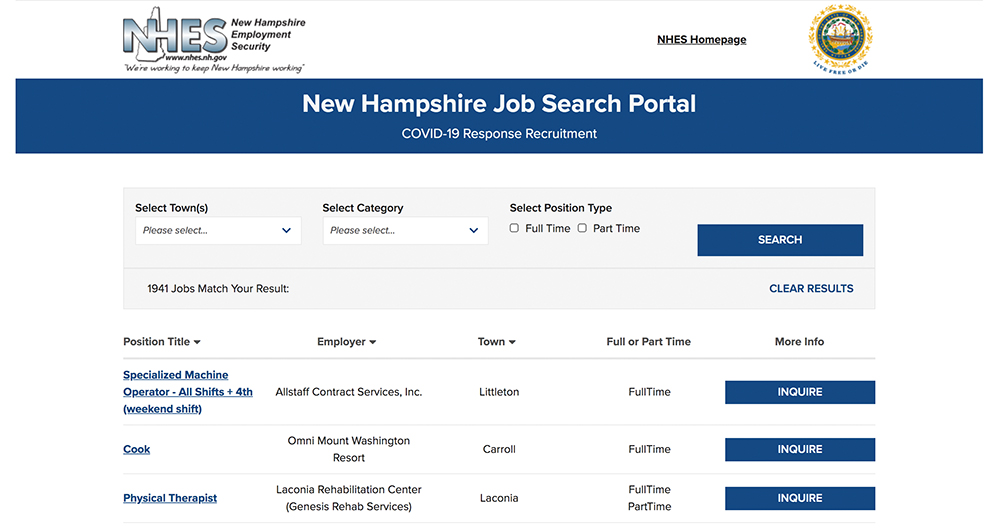

To support such efforts, NHES implemented new technology to connect job seekers to employers faster than ever. “Our new microsites were targeted to people utilizing the unemployment program, and we’ve now pivoted to work with them on re-employment,” Lavers says. “We created the New Hampshire Jobs portal for an easy way to connect during a time when it is so difficult to connect. A job seeker looking at their unemployment information is just two clicks away from connecting with the hiring manager from some of the most highly regarded employers in the state.”

NH Employment Security Job Search Portal.

Virtual job fairs, targeting different industries and regions of the state, are also eliciting a good response, especially with younger workers. “It is almost like speed dating; you go from table to virtual table and talk to employers,” says Lavers. He says the relationship between NHES and the BEA has become stronger during the pandemic.

Caswell has led a statewide effort to bolster collaboration to assist businesses by working with chambers of commerce. “We asked them to organize themselves regionally so that we could collaborate in providing CARES Act funds for them to come up with programs that are specific to business in that region.”

“We are building a foundation of regional support for the business community in collaboration with the state in the context of a broad strategy,” says Caswell. “If it’s just my department or just individual chambers or just regional development corporations and planning commissions and so on, it’s just not going to have the impact that we’re going to need.”

Looking for Safe Harbor

As businesses look to the new year and continue to find new ways of doing business in the pandemic, Roche says the BIA will once again try to put forward a safe harbor initiative. Roche says at the start of the pandemic, it became clear that employers could face COVID-19-related liability litigation from employees and their families, customers and visitors to their facilities, while schools could potentially face lawsuits from parents.

“We began advocating last spring for the creation of a safe harbor so that employers that are following CDC and state guidelines would have a carve-out against spurious lawsuits,” Roche says, but the effort did not gain traction last spring.

Roche says when he approached Sununu about supporting the effort the governor said such action needed to be taken at the federal level, but Roche says that seems unlikely now and he will try at the state level with a NH State Senator lined up to sponsor the measure and plans to gather additional support.

“This is the last thing employers need who are struggling to get back on their feet is to be sued by someone claiming they contracted the virus. This legislation will not protect employers that are negligent or disregarding health and safety protocols,” Roche says.

Looking back over the past year, Sununu says if he had to do it all over again, it’s hard to say what he would do different. “I feel confident we really walked a very good line in a very tough situation. With vaccine distribution underway and the first round expected to be completed by mid-January, the inauguration and new session of the House and Senate ready to get underway, it’s a great sign of hopefully an end to what has been a very tough year for everyone.”

Education and Paid Family Leave Among Sununu’s Top Priorities

Education will be another hot topic in the legislature this year. The Commission to Study School Funding approved its final report Nov. 30, which contains recommendations to fundamentally change the state’s education funding system, including how the state defines an adequate education and determines state aid to school districts. The recommendations also include ensuring special education expenses are fully funded, restoring school building aid and expanding access to affordable early childhood education.

“It is definitely the right time to have this discussion. A lot of folks out there who pay a lot on their taxes, their kids aren’t in school and they’re stuck with remote learning. This has led to a lot of discussion about how funding is done from parents wanting to have a little more control over the funding that dictates the path of their child’s education,” says Gov. Chris Sununu. The legislature is expected to tackle other major education bills this session.

Demographic changes are reshaping education, Sununu says, including declining enrollment despite population increases as people move to NH but have fewer kids. “We fund dollars per child and I funded at a higher level than any governor in history, but when you have three or four fewer kids in the classroom, that’s tens of thousands of dollars that just left that classroom,” he says. Saddled with fixed costs, Sununu says schools need to examine consolidation or new models.

School Choice and Charter Schools

Sununu says with schools teaching students remotely due to COVID-19, parents whose jobs are affected by having to stay home with children are getting more vocal about how the state is funding education. “Why are those dollars not following my kid? The dollars are following more the institution than the child and a lot of people, I think, are taking issue. I think it means a new model of education. I don’t think it all gets done this year, but I think there’s going to be a new emphasis on independent and conservative Democrats to join with a lot of Republicans to say we need to be more about the outcomes for the child [and] not just pumping more money into a system.”

The new legislature is considering a $46 million federal grant for charter schools. “It’s one of the first things they’re going to do is bring the fiscal committee together and accept those funds so we can start expanding our capacity in charter schools.”

Early Childhood Development

Sununu says he has worked to rebuild not just the system but the thought process surrounding early childhood development.

“We worked hard with the Department of Education and UNH [on] securing a $26 million grant around early childhood development. It will allow us to do a lot of interesting things that we’ve never done before so we’ll be watching and shepherding that through.”

Paid Family Leave

The family leave proposal will be back, according to the governor. “I think we found a very innovative way to provide paid family leave without incurring an income tax. Simply by having the state provide paid family for all the state employees, it creates about a pool of maybe 10,000 individuals. We have a private insurance company provide that insurance for that pool and then, because it’s such a large pool, the premiums would be very low and now you let all the other business of the state and individuals decide whether they want to pay in at that low price and buy that insurance,” he says.