This 10,000-square-foot warehouse facility listed by Colliers International is located at the southern end of the Manchester-Boston Regional Airport. Courtesy photo.

The beauty of a honest-to-goodness building boom for commercial real estate developers is that everything from available land for new construction to existing buildings waiting to be transformed is in play. The downside is the supply doesn’t meet the demand, and for businesses seeking space, timing is everything.

“There is decreasing vacancy and increasing rates, which would justify more development,” says Roger Dieker, a senior vice president and managing broker at CBRE in Manchester for 15 years.

The Interstate 93/Route 3 office market vacancy remained flat in 2017 with an overall vacancy rate of 10.4 percent, and CBRE is forecasting it will likely remain flat again in 2018, “even as office employment increases slightly,” according to CBRE/New England’s 2018 NH Market Outlook report. “Tenants will continue to take advantage of new workspace concepts that require fewer hard-walled offices and smaller meeting spaces. Rental rates should remain steady as well.”

The CBRE report also states that demand for office space remains high in the Seacoast and despite new office construction on the horizon, it is unclear if it will come on the market fast enough to “alleviate the high demand, as not all new construction will be available for lease. At the Pease Tradeport, there are a handful of projects at varying stages of the approval process or construction. The majority are pre-leased and build-to-suit, which leaves tenants currently in the marketplace with few options.”

Among the hot spots for office space is Salem, according to the CBRE report, citing the Tuscan Village development at Exit 1 breaking ground and a new 33,000-square-foot office building at 21 Keewaydin Drive.

Industrial Market Tight

Demand for industrial space is high for both existing buildings and for land for new construction with properly zoned land with sewer and water, Dieker says. In fact, the CBRE report states that not only did demand for industrial space in southern NH steadily increase in 2017, so did rental rates in several local markets.

“Landlords have been able to successfully secure longer-term leases at higher rates and with fewer concessions due to the current climate,” the CBRE report states. “Vacancy dipped from 7 percent in 2016 to 6.6 percent in 2017, illustrating an increased demand for industrial product.” Higher industrial vacancy rates and rents are expected to continue this year, the CBRE report states.

“With climbing construction costs, it will remain less likely to see new industrial construction built on speculation, though as the economy continues to improve, more developers and growing companies will break ground on modern state-of-the-art facilities. However, with a current lack of new facilities and tightening market conditions, quality options will remain scarce in both the Interstate 93 and Route 3 corridors, with less time on the market across the region for both existing inventory and any newly available industrial space,” the CBRE report states.

The industrial market is even tighter in the Seacoast with businesses either finding limited or no options that met their needs, the CBRE report states. “As a result, owners were able to demand high lease rates and sale prices and were unwilling to negotiate terms and conditions. Users have been forced to expand their searches and consider buildings that are not optimal. In some cases, users have had to look into other markets such as Manchester or out of state,” the report states.

When industrial properties that are ideal for a company’s distribution operations do come on the market, they usually don’t last long. For example, a 176,000-square-foot, former mail distribution facility with 30 dock bays on Heritage Avenue in Portsmouth represented by CBRE went on the market in late 2017 and has a sale pending.

These trends in the Seacoast industrial market continue in 2018, resulting in a “sluggish” market there and limiting options for “new companies who want to relocate to the Seacoast,” according to the CBRE report. “New construction will continue to be considered, but given the increase in construction prices, there aren’t many new builds anticipated for 2018.”

While space at Pease International Tradeport in Portsmouth and the Manchester Industrial Park area are tapped out, Dieker says there are opportunities in places like Merrimack and Londonderry along the I-93 corridor and around the Manchester-Boston Regional Airport.

A 10,000-square-foot warehouse facility listed on the New England Commercial Property Exchange’s website by Colliers International in Londonderry in the southern end of Manchester-Boston Regional Airport is one example of the type of commercial real estate that exists.

Big Box Retail Makeovers

There is an abundance of large retail spaces and former big box stores, and some are being remodeled to better meet market demand, Dieker says. For example, the former Lowe’s store in Manchester was repositioned into a new Chunky’s Cinema Pub and entertainment complex, he says.

The former Lowe's store in Manchester, above, was converted into a Chunky's Cinema Pub, below. Courtesy of TFMoran.

As more big box retailers and mall giants recede and close up shop, Dieker believes they will give way to new businesses. “A lot of these malls are struggling,” he says.

It’s not just the big box stores getting makeovers. Some owners of obsolete industrial buildings are updating and repurposing them to make them attractive to retail and mixed-use tenants, according to the CBRE report, pointing out that the former Osram-Sylvania industrial property on South Willow Street in Manchester has been repurposed into a 300,000-square-foot, multi-tenant retail space.

Multi-Unit Housing Demand

As businesses continue to grow and new ones move to the state, and the population in Southern NH increases, Dieker says there is also demand for multi-unit residential housing construction. The key is helping developers locate the right parcels of land on which to build, he says.

Judy Tinkham, owner of Tinkham Realty Inc., in Londonderry, says the demand for multi-unit residential housing continues to be strong in communities like Londonderry, Derry, Windham and Hudson.

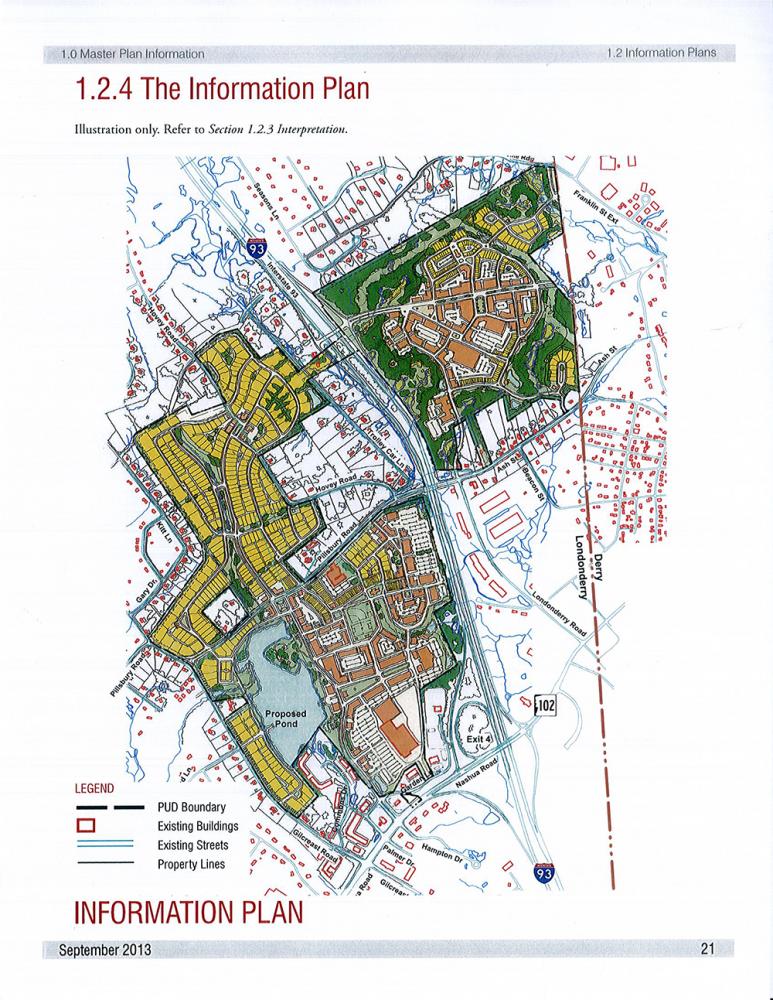

“We have some big developments coming on line and more new construction projects are needed to meet the demand,” Tinkham says. One example of these new projects in the pipeline is Woodmont Commons, a 700-acre development in Londonderry that will be a mix of retail, office space and residential condos, Tinkham says, as well as an elderly care facility and a performing arts center, according to the development’s website. The developer’s goal is to create an “Urban Village in the Rural Countryside.”

Woodmont Commons in Londonderry.

Looking to the Future

One of the major goals of Gov. Chris Sununu is to attract more companies to the Granite State. The current tight real estate market makes that challenging. Tink-ham says that if the state wants to increase the chances of landing a major employer like Amazon (the state failed to make Amazon’s short list of 20 sites under consideration for is second headquarters), it should consider adding more tax incentives and create the appropriate infrastructure to meet the needs of such large companies.

As for the current market, Tink-ham says there is no way to know how long the building boom may last.

She does believe that the peaks and the valleys that used to be a 10-year window are now down to a two- to three-year window because of the nature of the economy.

What’s trending today in the commercial prime real estate market in NH may not be trending tomorrow, Dieker observes. Commercial real estate developers will adapt to whatever future trends emerge.

Why Properties Don’t Move in a Hot Market

It is a good bet that you have seen your share of empty retail spaces at the local shopping mall and along Main Street as well as factory warehouses and office buildings for sale or lease that seem to be on the market for an extended period of time.

When asked why this is the case when there is demand for prime commercial real estate across southern NH, developers say it all comes down to what the property in question is trying to command.

Judy Tinkham of Tinkham Realty in Londonderry has seen this scenario play out many times. “It all comes down to whether they are listing it at fair market value. If they are over fair market value, they will not sell it,” she says.

It is understandable why a property owner wants to get as much as they can for their commercial building. But they have to figure out the middle ground between what they want and fair market value to make it work, she says.

The other obstacle that makes it hard for the seller to lower their price and move a property is they have to command a certain price so they can move on to another property to meet their needs, Tinkham says.

When her company looks at a prospective property on behalf of a client, Tinkham says her firm will do a comparative market analysis to help sellers understand the fair market value. “If they are way above the range, they will not be successful,” she says. “I find the majority of the sellers are reasonable.”

Roger Dieker, a senior vice president and managing broker for 15 years at CBRE in Manchester, says commercial properties often sit on the market for an extended period of time because the seller or lessor cannot afford to take an offer that does not meet their financial goals. “No rent is better than low rent,” he says.

In the case of office buildings, Dieker says leases are tied to the finances based on the assumptions of what the leasee can get, and they can’t just lower their expectations of what they need to generate value as it would diminish underwriting for their financial plan.

Eventually, these commercial properties will move as long as the owners can hang in there long enough to see it through, Dieker says.

Current Issue - April 2024

Current Issue - April 2024