A survey of young adults, conducted by Merrill in partnership with Age Wave, finds that financial independence defines adulthood today (75%)—more so than the traditional milestones of employment (61%), homeownership (30%), or starting a family (20%). However, due to mounting debt, higher costs of living and other hurdles, 80% of young adults say it is harder to be financially independent than it was for previous generations. Seventy percent of Baby Boomers, the parents of most of today’s early adults, agree. The study also finds that despite unique financial challenges, today’s women are progressing through early adulthood faster and more successfully than men.

“Early Adulthood: The Pursuit of Financial Independence” takes an in-depth look at the experiences and challenges of contemporary early adulthood (ages 18-34): pressures of new roles and responsibilities, pursuit of education and burden of student loans, power of intergenerational interdependence and ripple effects of debt. The study reveals that one in four early adults with a 401(k) have already made an early withdrawal, primarily to pay off credit card or student loan debt.

The study surveyed a nationally representative sample of more than 2,700 respondents in the U.S., with a focus on those between the ages 18 and 34. Key findings include:

• Financial resources are the top barrier to achieving goals. Early adults cite finances as their number-one source of stress and top barrier to achieving life goals, such as buying a home and starting a family.

• Being debt-free defines financial success. Early adults confront nearly $1.6 trillion in cumulative student debt today, according to the Federal Reserve Bank of New York’s Center for Microeconomic Data. Yet the survey finds 60% define financial success as being debt free, compared to only 19% who say financial success is being rich.

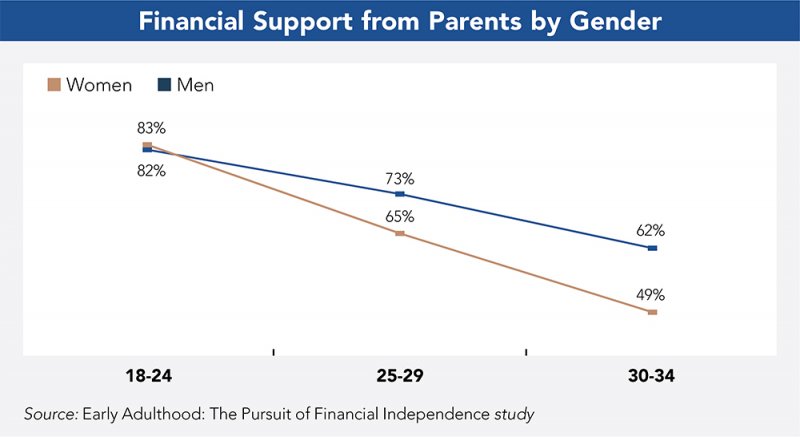

• Parental financial support is the norm. Seventy percent of early adults have received financial support from their parents in the last year, and as many as 58% say they would not be able to afford their current lifestyles without ongoing support.

• Social media is exacerbating financial pressures. Two-thirds (68%) of early adults fear they are continually missing out on what their peers experience. This is fueled by the pervasive use of social media, leading early adults to compare their financial accomplishments to their peers online. As a result, 82% of early adults say they feel pressure to make a lot of money and 60% say they feel pressure to buy things they cannot easily afford.

The Gender Difference

According to the study, women are outpacing men in the quest for financial independence—despite greater student debt, unequal pay and more family caregiving involvement. Women carry almost two-thirds of the cumulative student debt in the U.S., according to a 2017 report, “Deeper in Debt: Women and Student Loans,” by the American Association of University Women.

• Launching faster with less parental support. Among those in their early thirties, 49% of women receive support from parents compared to 62% of men. Women are about half as likely to be receiving support across nearly all expense categories, including food and groceries (40% men vs. 23% women), rent/mortgage (33% men vs. 15 % women), vacations (36% men vs. 17% women) and student loans (32% men vs. 14% women).

• Long-term view on finances. Women are more likely than men to say their highest financial priority is saving for the future and paying down debt (72 % women vs. 60 % men). Meanwhile, men are significantly more likely to say their highest financial priority is to “enjoy life now” (40% men vs. 28% women).

Steps Toward Independence

With all of that, there are still ways to counteract the numbers and achieve financial independence. The path is much easier when started sooner. It is essential for recent college grads to adopt positive, proactive financial behaviors that can help them cut the cord, and parents must set clear boundaries to avoid jeopardizing their own nest eggs and creating a cycle

of codependency.

Here are some tips:

• Spend wisely: Cutting spending is a great way to start, but learning smart ways to spend is just as vital. Decide what kinds of spending will benefit long-term goals and always allocate a portion of income for savings.

• Navigate the burden of debt, especially student loans: Concentrate each month on paying back the minimum on every debt owed and when there is money to spare, pay more. Also, avoid high-interest debt like credit cards.

• Start to invest: The more time money is allowed to grow, the larger amount one will have in the future. It’s a simple enough calculation, but many people don’t take advantage of the growth-over-time method. Try to take advantage of it—it will make it easier to pursue future goals.

• Take advantage of employee benefits: If a company offers a 401(k) and employee match programs, take full advantage of everything being offered.

• Take ownership of personal wealth. Stick to a clear budget, put money into savings and invest assets over time. People need to consciously develop a sense of agency around their money.

• As a parent, set boundaries and hold tough conversations. Parents spend $500 billion annually on adult children—twice what they contribute to their retirement. Use graduation as a time for tough conversations about establishing new money habits without sacrificing one’s savings.

Paul Lehrman is the Northern New England market executive for Merrill, an investment and wealth management firm. For more information, call 603-628-3200 or visit local.ml.com/manchester_nh.

Current Issue - April 2024

Current Issue - April 2024