The Granite State is a popular choice for seniors who are looking to relocate for their retirement. While maintaining a lower cost of living than most other New England states, NH also has some of the lowest retirement taxes of any state in the country, according to SmartAsset.

In its fifth annual study, SmartAsset analyzed sales, property, income, fuel and Social Security tax data to rank locations on how financially favorable they are for retirees. The study analyzes a retiree with $50,000 in annual income to see how much they will pay in income, property, sales and fuel taxes.

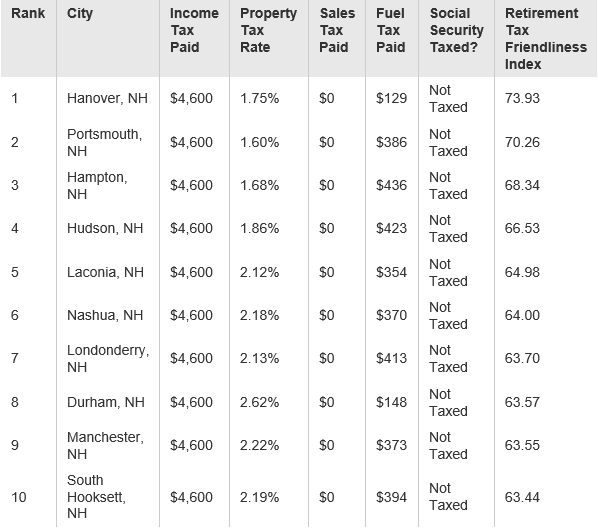

The table lists the cities that lead NH in retirement tax friendliness.

Methodology: The study aims to find the areas with the most tax-friendly policies for retirees. To do that SmartAsset looked at how the tax policies of each city would impact a retiree with a $50,000 income. A hypothetical retiree is getting $15,000 from Social Security benefits, $10,000 from a private pension, $10,000 in wages and $15,000 from retirement savings like a 401(k) or IRA. View the full study.

Current Issue - April 2024

Current Issue - April 2024