Tourists ziplining in NH’s Lakes Region. Courtesy of the Lakes Region Tourism Association.

It’s budget season at the State House and Gov. Chris Sununu will deliver his budget proposal to the legislature this month. And there will be plenty of competition for those state dollars. However, one area, habitually overlooked for the past several years, also happens to be one of the top two economic drivers of the state’s economy—tourism.

State investment in marketing this critical sector has remained flat for years and a 2016 report showed that NH struggles to differentiate itself from its neighbors.

Just how big is tourism as an economic driver? In 2017, NH hosted 2.23 million visitors who spent $5.5 billion, says Victoria Cimino, director of the NH Division of Travel and Tourism. Cimino says that’s accomplished with the 12th lowest budget in the country for marketing tourism per the U.S. Travel Association. In fact, Travel and Tourism has been flat funded at $7.6 million since FY 2016 while the national average for state budgets for tourism is $18 million, Cimino says.

“I’m not suggesting we should be at an $18 million budget. If we were fully funded, we would be closer to Maine’s marketing budget and that of surrounding states,” Cimino says, noting Maine tourism funding is $13 million annually.

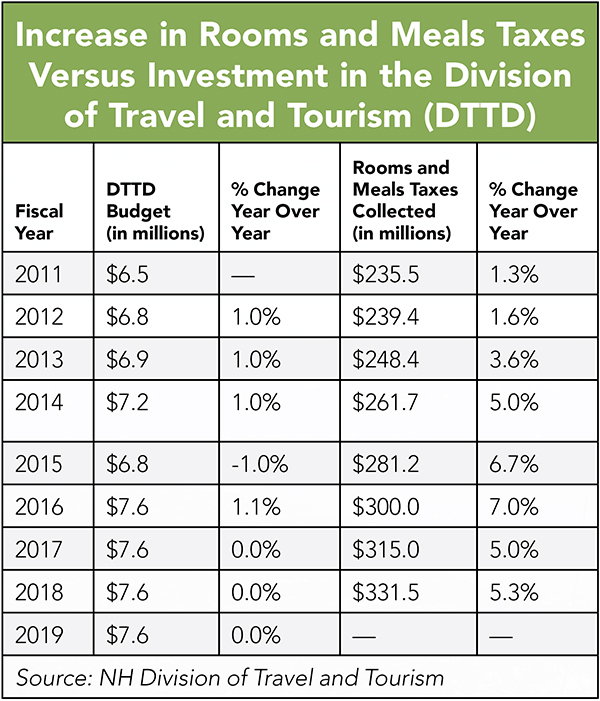

In NH, a state statute enacted in 2012 stipulates 3.5 percent of net income from rooms and meals taxes to be invested in the NH Division of Travel and Tourism. The amount of rooms and meals taxes the state has collected has risen from $235.5 million in FY 2011 to more than $331 million in FY 2019. If the state had followed the statute, the department would have received $9.75 million for FY 2018/19, Cimino says.

“Compared to other states, it really is a shoestring budget,” says Jayne O’Connor, president of White Mountain Attractions, Association the largest tourism marketing organization in NH outside the state’s department. She says the Legislature has suspended the statute each year since it was enacted.

“When you look at the tremendous number of places you need to advertise, it [the state budget] hasn’t kept up,” O’Connor says, adding she does not understand why the state does not invest more given that it would be paid for by people from outside the state through rooms and meals taxes. She adds that tourism and hospitality businesses also contribute to state coffers through business taxes.

Even when the state has stepped up funding, it has been marginal. Between FY 2011 and 2016, the NH Division of Travel and Tourism received budget increases of 1 percent, except FY 2015, when it experienced a 1 percent decrease. O’Connor says while the Legislature technically level funded the Division the past few years, it really resulted in decreased budgets as marketing costs keep rising.

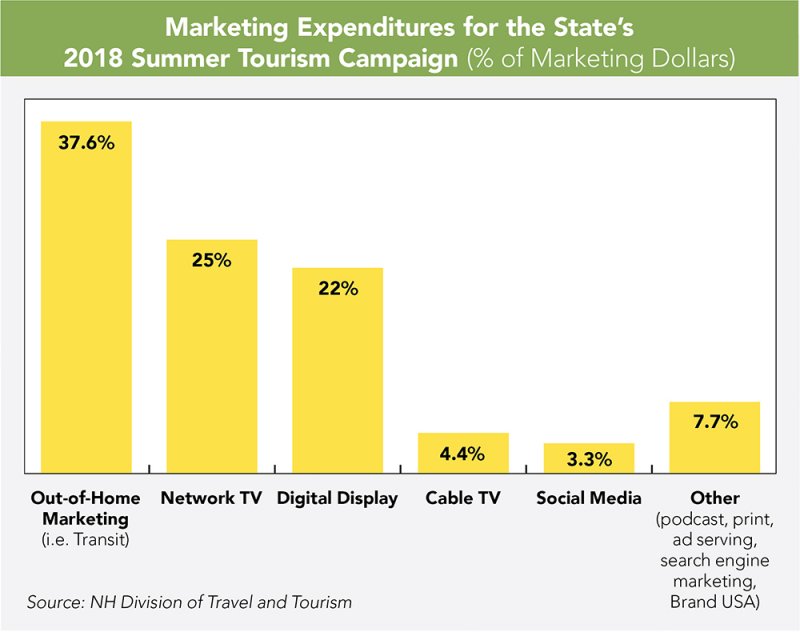

What’s in the $7.6 million total budget? For starters, the budget covers the salaries of a director and a staff of 89: 82 in the Bureau of Visitor Services, six in tourism promotion, and one employee on the Film Bureau. The balance of the budget—$5.8 million—supports marketing the state and its tourism offerings, and strategic partnerships helps to stretch those dollars.

Cimino says the return on investment for those marketing dollars is significant. A fall 2017 and winter 2018 return on investment study, conducted by Insights Strategic Marketing and Research, shows every dollar spent on media generates $270 in visitor spending, she says.

But even that return has not helped to increase the investment. “There is a point of view that travelers will come to New Hampshire whether you advertise or not and that is not true. We can determine through our research the influence our marketing has,” Cimino says, explaining the state contracts a research firm in Indianapolis to measure its effectiveness—a firm that has also worked with California, Oregon and Texas. The firm found 9 percent of visitors surveyed who hadn’t considered NH as a vacation destination booked travel to the state based on the state’s advertising, Cimino says.

“If we were able to increase our media outreach, we could increase visitation and spending to the state,” she says, adding that if the Division were funded at the level called for by statute those additional dollars would go toward two things: marketing and a position to focus on the MICE market (Meetings, Incentives, Conventions, and Exhibitions).

“New Hampshire is the only state in the country that does not have a Convention and Visitors Bureau and is simply absent from this niche of group travel,” Cimino says.

In order to ensure the budget is used as effectively as possible, Cimino says the Division bases its marketing decisions on data culled from consumer perception surveys, advertising effectiveness studies, return on investment analysis, market share reports, and domestic and international travel barometers.

“They [Travel and Tourism] have done a wonderful job, the last couple of years especially, to make sure the data matches the marketing and the marketing matches the data. That’s important as things change in the marketplace,” O’Connor says, adding they stretch the money as far as possible.

O’Connor says she hopes the state increases the Travel and Tourism budget. “There’s so much competition out there for people’s leisure time,” she says.

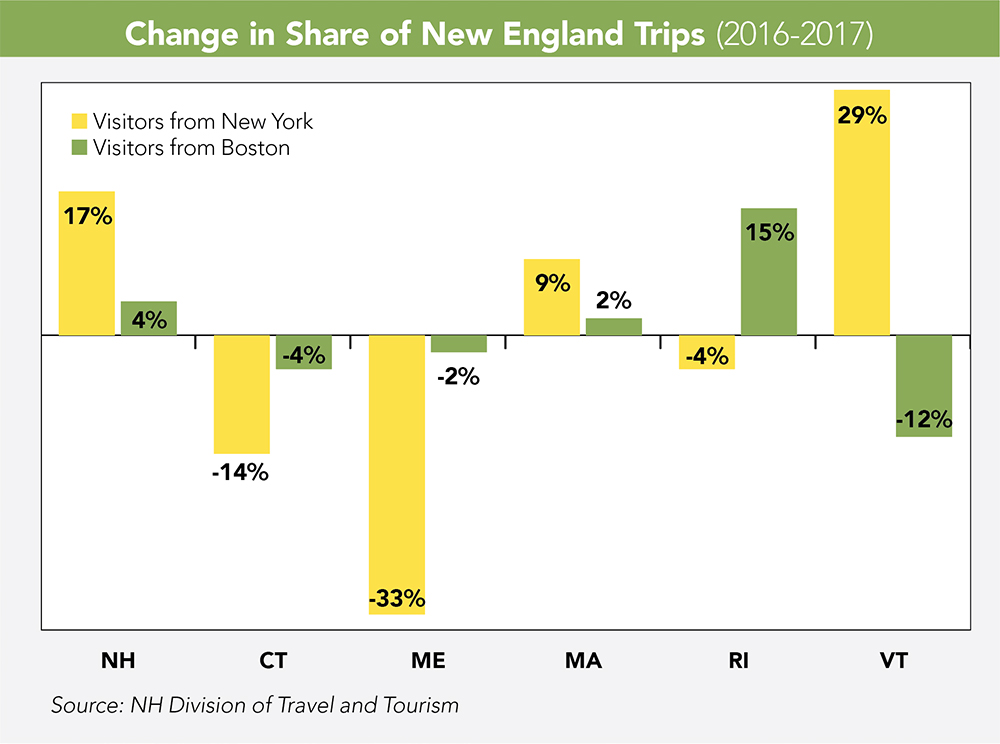

Domestic Marketing

The NH Division of Travel and Tourism primarily targets the Boston and New York markets as both regions offer an easy drive and low hanging fruit. But it has begun to explore markets that are further away to promote the fall season as the number of visitors who travel from further away is highest during the fall, Cimino says.

Summer is NH’s busiest tourism season and so the Division makes the lion’s share of its media buys in May and June. As Boston continues to be a prime market for NH tourism, the Division has found ways to make a big splash there. In summer 2017, it launched its “North Station Domination” campaign where every piece of advertising in North Station was related to NH, Cimino says.

The NH Division of Travel and Tourism’s 2017 “North Station Domination” campaign. Courtesy photos.

But there are a number of various campaigns used to reach potential visitors, particularly those who would be attracted to the state’s beauty and desire outdoor recreation.

The Division partnered with National Geographic, for example, to create custom content for visitors on National Geographic’s website and social media channels that “drove high amounts of sticky traffic to VisitNH.gov, 95 percent of which were new users” thus increasing awareness of all NH has to offer, Cimino says.

In 2017, the Division partnered with two adventure travel-based influencers to engage their followers in creating photos of NH. “We gained more than 1,000 new followers in a six-day period, 198,000 engagements on Visit NH tagged posts from the selected influencers, more than 150,000 video views, and a portfolio of high-quality visual and video content that will be reused seasonally,” Cimino says. “We were even reposted by Reese Witherspoon. How cool is that?”

The Division also partners with multiple state agencies and private organizations, including: Division of Economic Development, Division of Parks and Recreation, Department of Natural and Cultural Resources, Department of Agriculture, NH Made, Ski NH and the state’s regional tourism marketing organizations, Cimino says.

The Division also administers the Joint Promotional Program (JPP), a 50/50 matching grant program designed to support promotional initiatives developed by tourism groups and organizations. JPP grants range from $2,000 to $10,000 and the Division allocates 9 percent of its total budget to JPP, totaling $850,000 annually, Cimino says.

Among other tourism organizations that partner with the state are The Lakes Region Tourism Association and White Mountains Attractions. The Lakes Region Tourism Association is a nonprofit that has promoted tourism in its region since 1935 and has 450 members. “You constantly have to brand the region and keep it in the forefront,” says Amy Landers, executive director of the Lakes Region Tourism Association.

Landers says the Association used to concentrate its marketing in the spring to gear up for summer tourism but now spreads its marketing throughout the year promoting year-round offerings.

The Lakes Region Tourism Association operates on an annual budget of $685,000 and staffs a Tilton visitors center year-round and another in Alton Bay seasonally. It does a combination of print, digital and television advertising, Landers says, but also markets though social media and travel trade shows.

The Lakes Region Tourism Association operates on an annual budget of $685,000 and staffs a Tilton visitors center year-round and another in Alton Bay seasonally. It does a combination of print, digital and television advertising, Landers says, but also markets though social media and travel trade shows.

When it spends more marketing dollars in a particular travel market or invests in a new market, the Association surveys its members as to whether they saw an increase in visitors from that market, Landers says. The Association also surveys members as to when visitors start calling for information and bookings so the Association can accurately time its efforts, Landers says.

Of the Association’s eight trade shows each year are those that are aimed at the Boston and New York markets, Landers says. While the state attracts a significant portion of visitors from those markets, Landry says there’s a downside. Their proximity also makes those visits weather dependent as they are close enough to postpone or cancel plans if inclement weather arises.

The Lakes Region Tourism Association at a trade show. Courtesy photo.

Regarding maximizing her budget, Landers says they reach out to potential visitors further away, such as Pennsylvania, because they’ll keep travel plans intact no matter the weather, stay longer and spend more.

Another tourism organization and partner to the state is White Mountains Attractions Association that has promoted that region since 1958. It also manages Lost River Gorge and Boulder Caves, which in turn helps to fund White Mountains Attractions’ marketing. (Other sources of funding include member dues, selling advertising and grants.)

Another tourism organization and partner to the state is White Mountains Attractions Association that has promoted that region since 1958. It also manages Lost River Gorge and Boulder Caves, which in turn helps to fund White Mountains Attractions’ marketing. (Other sources of funding include member dues, selling advertising and grants.)

White Mountains Attractions’ budget is $2.4 million, which includes the cost of operating the White Mountains Visitor Center, its brochure distribution business and operating the Lost River Gorge and Boulder Caves attraction. About $1.1 million is spent on marketing, O’Connor says, which includes a mix of online, television, print and billboard advertising.

White Mountains Attractions sends 48,000 mailings annually to people who request vacation kits and produces 310,000 travel guides annually. “We didn’t think we would still be doing those at this point but I see cars pulling into the visitors center with the maps and travelers guides on their dashboard,” O’Connor says. (Those marketing materials can also be downloaded online.) It prints 100,000 copies of the National Scenic Byway brochure annually, which offers a downloadable audio version, 225,000 pad mats (the tear off maps) and 830,000 White Mountain maps and guides, which she says “tend to run out.”

It has three full-time marketing staff, and a part-time staffer, who handle social media marketing, ad placement, content writing, ad production and print production. “Having these services in-house keeps the web content and social media fresh and responsive,” O’Connor says.

White Mountains Attractions’ visitor centers host 110,000 visitors annually, O’Connor says, many from Boston, New England and New York, and, increasingly, from mid-Atlantic states as well.

O’Connor says many tourism businesses are expanding their year-round offerings such as ski resorts now offering attractions. Keeping seasonal workers working longer or being able to offer year-round jobs draws more employees and businesses to the region, she says. It also means the organization has to find ways to engage potential visitors throughout the year and make its marketing dollars go even further.

Many ski resorts are offering summer attractions including the giant swing at Cranmore Mountain Resort. Courtesy of White Mountains Attractions.

“One of the reasons we do so well is we are willing to put in time and effort to follow the state where they go and show people if you’re coming to New Hampshire, you are coming to the White Mountains,” O’Connor says.

International Markets

International visitors are an increasingly lucrative and competitive market and NH and New England officials are combining efforts to attract more of them. Discover New England was founded in 1992 as a nonprofit cooperative to promote New England internationally, says Lori Harnois, executive director.

Discover New England partners with the tourism offices of Connecticut, Maine, Massachusetts, NH, and Rhode Island as well as regional travel trade professionals. Harnois says international travelers tend to be more familiar with New England as a region than they are of the individual states.

The Discover New England booth at World Travel Market in London, England in November 2018. Courtesy photo.

“The collaborative approach also allows us to save on marketing costs, which in turn allows us to be in more international markets,” she says, adding New England’s top visitor markets are China, United Kingdom, Germany, India, France, Japan, Brazil, Australia, South Korea, and Scandinavia.

“International visitors are an important component to New England’s tourism mix. These travelers often spend more, are not weather dependent, fill rooms mid-week, and book well in advance. Most international travelers to New England visit a minimum of three states per visit,” Harnois says.

“According to our research firm, Travel Market Insights, New England welcomed 2.1 million overseas visitors in 2016, a 3 percent increase. These travelers spent $6.1 billion traveling to destinations in New England. By 2022, New England is forecast to welcome 2.58 million overseas visitors, a 26 percent increase since 2016.”

Discover New England has a $1 million budget generated from dues and memberships, as well as programs it coordinates such as its annual Tourism Summit and International Marketplace. That budget funds its efforts to attend or host 10 tradeshows, sales missions, and marketplaces per year, Harnois says, with each participating state contributing $125,000 annually.

New Hampshire’s international efforts are focused on wooing visitors from Canada as well as the United Kingdom, Ireland, Germany, Italy, France, Australia, and New Zealand.

O’Connor says the international market is an important and growing segment of visitors to the White Mountains, having grown from about 10 percent of visitors to the region a few years ago to 16 to 18 percent today. “We’ve seen [visitors from] about 72 different countries in a year coming through our visitor center,” she says.

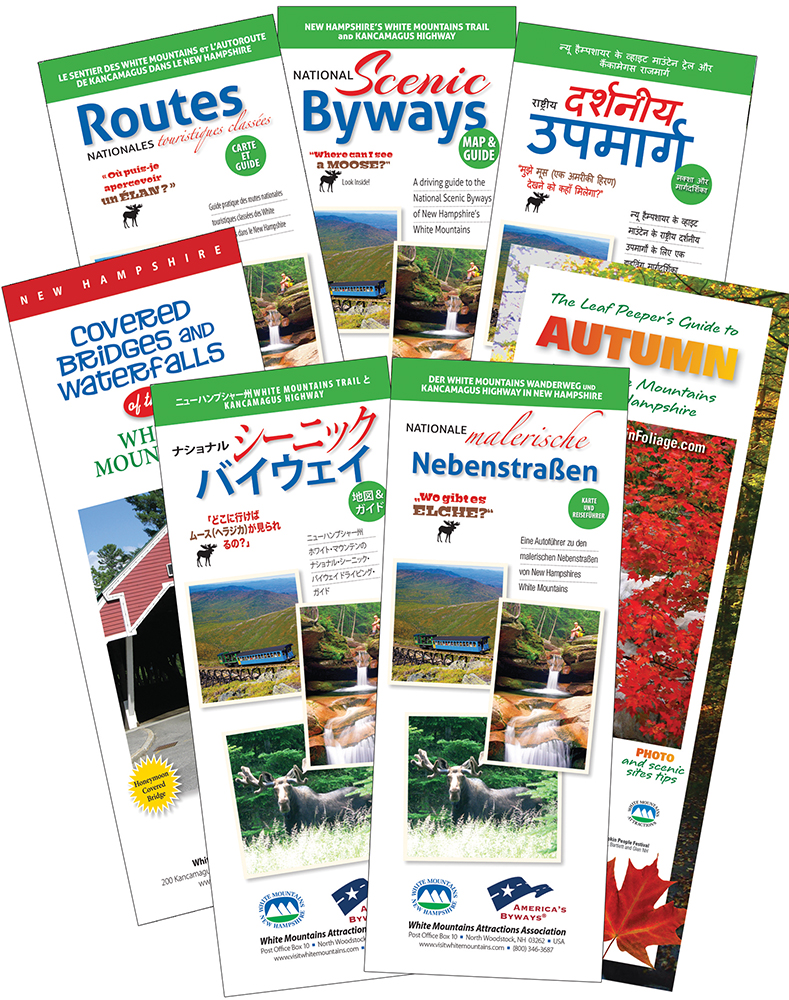

White Mountains Attractions works closely with Discover New England’s efforts to promote the region overseas and attends the same trade shows, O’Connor says. White Mountains Attractions attends trade shows in six countries annually. “People can take a two- to three-week vacation visiting New England and we want to make sure if they are coming to New England that they are visiting the White Mountains,” she says. Fully 10,000 of the organizations’ maps are printed in French, German, Japanese, Chinese and Hindi, O’Connor says.

White Mountains Attractions works closely with Discover New England’s efforts to promote the region overseas and attends the same trade shows, O’Connor says. White Mountains Attractions attends trade shows in six countries annually. “People can take a two- to three-week vacation visiting New England and we want to make sure if they are coming to New England that they are visiting the White Mountains,” she says. Fully 10,000 of the organizations’ maps are printed in French, German, Japanese, Chinese and Hindi, O’Connor says.

Need to Differentiate

It’s natural that much of NH’s marketing focuses on its natural beauty and outdoor recreation. However, those are the same traits that lure tourists to our neighbors. An image perception survey was conducted in 2016 among 1,016 travelers within a day’s drive of NH (a radius of 50 to 300 miles). The survey explored levels of familiarity, appeal, and visitation with NH and the surrounding New England states.

The survey found that compared to surrounding New England states, NH has a “comparatively low level of visitation, familiarity, and associated appeal and interest.” This is due in part, the report states, to NH’s image that it offers outdoor recreation, limiting its appeal to a “singular segment of the traveling population.” The report also found that means NH is “undifferentiated” from Vermont and Maine.

“Among NH’s target markets, New York and Pennsylvania have the leading share of familiarity with the state, but NH’s familiarity is similar to that of Vermont, Maine, and Rhode Island,” the report states. In fact, Maine and Vermont ranked higher than NH as states that tourists would most likely visit. “New Hampshire is competing as an undifferentiated competitor for a limited outdoor travel market,” the report states.

“We’ve got maple syrup but so does Vermont. We have lobster but so does Maine. We highlight that New Hampshire has the best of what New England has to offer,” Cimino says.

Tourists visit Lost River Gorge, which is managed by White Mountains Attractions. Courtesy photo.

O’Connor says she would like to see the use of more iconic imagery in ads to differentiate NH from Maine and other states. “We want to make sure those iconic images that people are familiar with are in there—Mount Washington, Hampton Beach or Portsmouth. Some of that is tough for the state because the state has to be fair and balanced to all businesses and regions,” O’Connor says. She adds that is where the regional tourism associations serve a role by enhancing the state’s messaging with their own that does include those iconic images.

Cimino notes the state also markets other tourism activities through the Division’s website, social channels, public relations, visitors guide, and a blog launched in September that features at least three posts each week. The state also highlights attractions, museums, restaurants, wineries and breweries, tax-free shopping, historic sites, and more.

Cimino notes VisitNH.gov, the Division’s online presence has 376,748 fans on Facebook (more than any other New England state), 53,700 followers on Instagram (second only to Maine), 32,600 Twitter followers, 641 YouTube subscribers, and 3,000 followers on Pinterest.

As a division of the Department of Business and Economic Affairs, there has also been more emphasis on promoting NH not only as a great place to visit, but as a place to work and live.

“Success is ultimately dictated by the growth of Rooms and Meals tax revenue; the Division’s business goal is to achieve a 5 percent increase each year,” Cimino says. “It is an investment into one of the major economic drivers for the state."

Current Issue - April 2024

Current Issue - April 2024