Like many sectors, the insurance industry is facing a looming shortage of workers as the average age of an agent is close to 60, says Jeff Holmes, COO of the Strategic Insurance Agency Alliance (SIAA) in Hampton. It is vital to replace those retiring workers as the insurance industry is projected to continue to grow 5% nationally between 2019 and 2029, faster than the average for all occupations.

In NH, the insurance industry is expected to grow by 4.2%, adding 550 jobs between 2018 and 2028, according to long-term industry projections from the NH Employment Security’s Economic + Labor Market Information Bureau (ELMI). The insurance industry even managed slight employment growth in NH during the pandemic. The industry declined from 13,100 jobs in January 2020 to 12,800 in May but increased to 13,300 by December, according to ELMI.

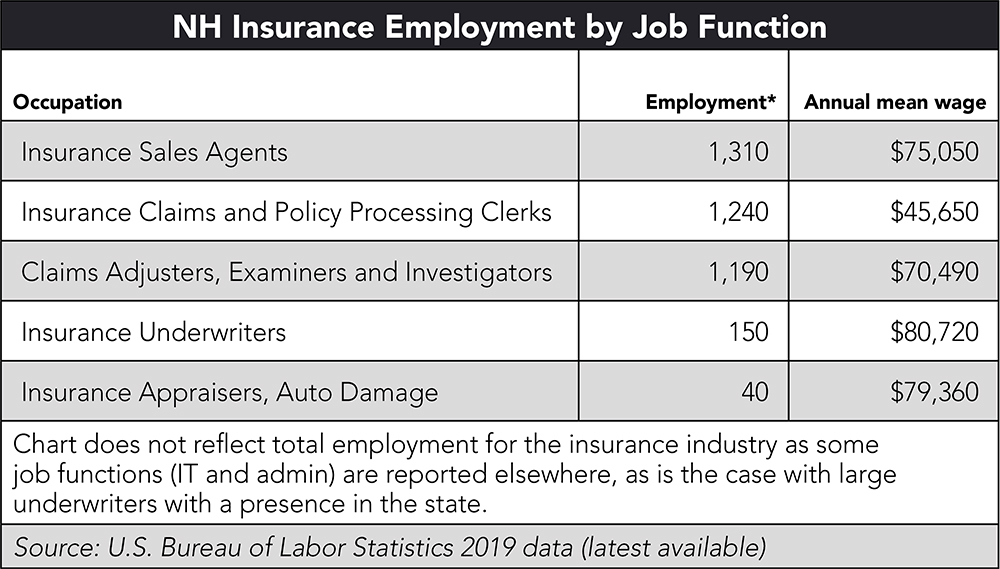

Central NH actually ranks among the top five nonmetropolitan areas in the U.S. for the concentration and number of jobs for insurance claims and policy processing clerks, accounting for three out of every 1,000 jobs in the region and paying an average salary of about $22 per hour.

Both Manchester and Nashua rank in the top paying metropolitan areas for insurance sales agents nationwide. According to the U.S. Bureau of Labor Statistics, the median pay for an insurance sales agent is about $24 per hour—just shy of $50,000 annually—but is even higher in the Granite State at $32.39 or more than $67,000 annually.

Pandemic Shifts

Thanks to technology, many insurance agencies were able to transition to a remote work environment without a great deal of disruption and keep employees serving customers. “Agencies were likely more prepared than we thought. We all had voice over IP phones, management systems that were online and cloud based,” says Steve Cote, president of Chalmers Insurance Group in North Conway.

Holmes says there is a definite distinction between those who did well and those who didn’t. “Those who learned to connect with their clients through a wide variety of technology did better than relying on legacy systems, which were getting lost with so many people home because of COVID-19,” he says. “Those alternate ways of connecting with people really allowed insurance agencies to make a stronger and better connection and create new clients as well.”

Holmes says SIAA, as an alliance of independent insurance agencies sharing best practices, has been promoting different service options for years to “let the client decide” how they want their policy serviced, which also requires a different skill set from employees. “That flexibility from a service perspective is also transforming what an agency looks like, where it’s unlikely a CSR [customer service representative] would simply do the job of helping clients without actually having a sales

component included.”

As technology continues to evolve and become more affordable, it has allowed firms to become more efficient and reduce the number of employees needed, says Rachel Eames, owner and founder of Eames Insurance in Concord, which meant she did not have to lay off or furlough anyone during the pandemic. “I am so pleased with the decisions we made in 2019 to go paperless; we were already doing electronic signatures and voice over IP phones,” she says. “A client dials our Concord or Newmarket number and gets whoever is available. We were truly ready.”

Finding the Next Generation

Embracing technology will also allow firms to attract the next generation of workers they need. As digital natives, Holmes says millennials and Gen Y are a perfect transition for the insurance industry. “When you look at the agency, the future is going to be heavily reliant on technology, but it is also going to be very embedded in the community at the same time. These younger generations bring such a presence when it comes to technology,” he says.

Holmes says when agencies place ads on job search platforms, the first stop for a millennial is going to be the company’s website. If that website is robust and current, they stand a chance of bringing in a potential new hire. “But if that website is stagnant, we have to realize for this new generation that’s where they’re stopping,” says Holmes. “Our verbiage in this industry is just so crazy. We have to transform how we talk to people and move away from some of the traditional language.”

Essentially for the next generation of potential customers, millennials and Gen Y, the insurance industry needs to find a way to reach them in terms they understand, both to attract them as customers and also as potential employees. If they’re not even buying or using a product or giving it much thought, they are less likely to be interested in working in that industry.

He says the agency of the future needs to take a holistic approach and understand that the brand is everything. Agencies must actively market to all the different channels including print, social media and email, and begin to reshape the image of the industry. “We need to move away from that legacy of what the industry is by creating an environment that is different. The office needs to look different, and people need to be excited about what they do, about the tools that they have.”

Cote says the pandemic will change the way agencies function for employees. “Even the most traditional agencies will never go back 100% to the way it was March 16,” he says. “I think it has created better home-life balance.”

Current Issue - April 2024

Current Issue - April 2024