The American Hotel & Lodging Association (AHLA) released a new report showing the average small hotel will require additional funding from SBA loans under the Paycheck Protection Program (PPP) in order to rehire employees or prevent further layoffs and keep their business open.

The American Hotel & Lodging Association (AHLA) released a new report showing the average small hotel will require additional funding from SBA loans under the Paycheck Protection Program (PPP) in order to rehire employees or prevent further layoffs and keep their business open.

AHLA also sent an urgent letter to Congress asking for additional funding for SBA loan program and several technical updates to the CARES Act to help these hoteliers keep their doors open and save jobs.

Sixty-one percent of U.S. hotels, or about 33,000 total—are defined as small businesses.

According to Oxford Economics the impact of this virus, and the associated national shutdown, is nine times worse than what the hospitality industry faced following September 11, 2001.

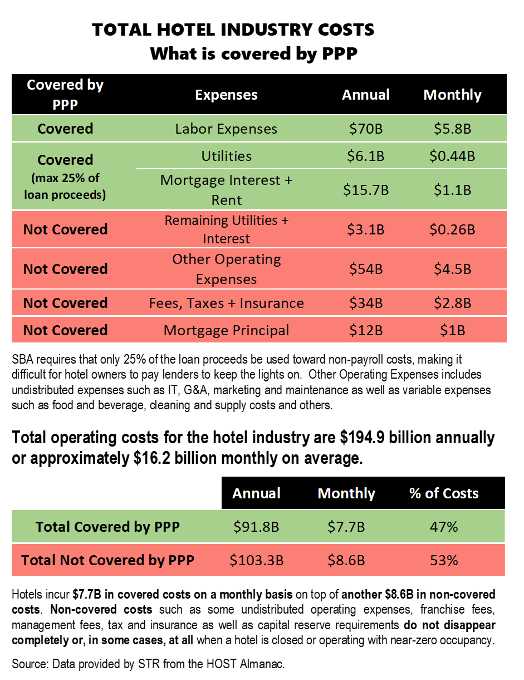

The report shows that “covered costs” as defined in the CARES Act cover only 47 percent of hotel operating costs. With revenues at 20 percent to 40 percent of the normal level for the remainder of 2020, the only solution for keeping employees on the payroll is to increase the PPP loan limits. If the CARES Act is amended to raise the loan limit from 250 percent average payroll to 800 percent of covered costs, most hoteliers could keep employees and keep their doors open.

“The CARES Act is a historic effort to meet the most serious health and economic challenges of our lifetime, and the hospitality industry recognizes and applauds every elected official who has helped meet these challenges,” says Chip Rogers, president, and CEO of the American Hotel and Lodging Association. “The policy solutions and technical corrections we offer do not overshadow the gratitude we have for the work already done to help save our industry. The additional funding and needed changes to the CARES Act are directly related to our only interests: saving jobs of our employees and supporting our small businesses.”