As the weather and the economy both heat up, several engineering sectors are as well, despite the cooling of other historically solid sectors.

Overall, engineering firms are experiencing an increase in demand for work on multifamily dwellings and mixed-use properties as well as a slight uptick in private aviation facility projects amid a smattering of hotels and resorts. Some sectors, however, have seen better days. While there is some investment in infrastructure projects, it doesn't match the mounting needs for infrastructure improvements. In addition, online shopping is changing the retail landscape, resulting in fewer box chain projects. That said, even the slower sectors are seeing some movement.

Housing Trends Spur Business

Bob Clarke, principal at Allen & Major Associates Inc., a Massachusetts-based engineering firm with an office in Manchester, says the firm is seeing an uptick in assisted living, multifamily dwellings and off-campus student housing. He explains the larger trend here stems from both the changing habits of aging baby boomers as well as the preferences of millennials during and after college.

University Edge apartments, off-campus housing for UNH students in Durham, was completed by Allen & Major Associates and includes 52 full amenity apartments (197 beds) and 8,800 square feet of commercial space. Courtesy photo.

“Basically, the baby boomers are starting to compete with the millennials,” Clarke says. “So you have the two largest populations; you’ve got young urban professionals that are graduating college that are looking to be in and around the city area and then you have the older baby boomers looking to be in the city area and sell that house they had in the suburbs.”

Robert Duval, president and chief engineer at TFMoran with offices in Bedford and Portsmouth, says the firm has seen multifamily dwelling business double or even triple during the past five years. While he agrees that one of the drivers is the preferences of boomers and millennials, he also notes the demand for affordable housing in general.

“The millennial group is more interested in living in an apartment, at least when they are starting their careers and then maybe after they start a family and then the kids get to school age, they think of moving into single family homes,” Duval says. Many millennials “are really looking for mobility and the ability to change jobs or commute to where the job is,” he says.

He adds millennials are looking for multifamily living that’s convenient, in a downtown or with easy access to highways.

Mixed-Use on the Rise

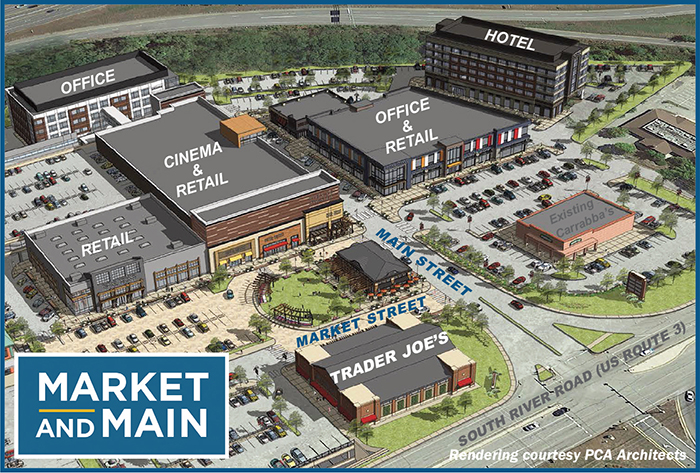

Another area seeing a boom, Duval says is mixed-use development. Duval points to a recent project involving TFMoran—the transformation of the former Macy’s site in Bedford into Market and Main on South River Road. This development on 16-plus acres will include more than 300,000 square feet of retail and residential space.

“The younger people like to live next to nice restaurants and active night clubs, convenient shopping and so forth. And so it’s beneficial to everybody,” Duval says, adding the shared infrastructure, such as parking areas, saves on construction costs, which adds to the allure of such projects for developers.

Above: TFMoran provided survey, civil/site engineering, landscape architecture and permitting services for the Residences at Riverwalk in Manchester. Courtesy of SMC Management Corporation. Below: Another TFMoran project at the former Macy's location in Bedford.Courtesy of Prellwitz Chilinski Associates.

But mixed use isn’t just for the young. Clarke says another active sector is assisted living and medical facilities constructed within mixed-use complexes. Allen & Major is working on the Silver Square in Dover. Located on the old Macintosh College campus, the existing buildings were razed and the site redeveloped into a mixed-use development with a new 76-unit assisted living facility, a Dunkin’ Donuts and a 66-guestroom hotel.

There has also been a considerable amount of renovation and rehab projects fueling business, Clarke says. “We’re seeing a lot of old dilapidated strip centers renovated,” he says, explaining developers have been buying older shopping plazas in areas like Pelham and Manchester and giving them a facelift to raise their profile.

Infrastructure Investment

Civil engineering is also active. Wendell “Wally” Shedd III, senior associate at Terracon in Manchester, says the firm has seen a tremendous amount of work in energy infrastructure and transmission lines, pipelines and substations, solar work and even some wind energy projects. “That sector continues to just really grow and blossom because of the needs of our aging infrastructure and the changes in technology that are happening within the energy sector,” Shedd says.

He offers several reasons. One of the biggest is fracking and the United States being a major producer and exporter of natural gas and petroleum, which has driven changes in power plant generation, pipeline patterns and shipping patterns for oil and gas.

Further, he says, the renewable energy boom has altered how the existing electrical grid is being used and has highlighted the need for improvement and reinforcement to allow multiple small inputs from smaller solar and wind projects. “Our grid is really evolving in that way,” Shedd says. “And then there’s the factor of just age. Nothing we build lasts forever, and the electrical grid, in the Northeast anyway, needs improvement.”

Underground, there may be more investment in water and sewer infrastructure, says Matthew J. Low, senior vice president and director of engineering operations at Hoyle, Tanner & Associates Inc., an engineering firm based in Manchester.

“We have miles and miles of pipes under the ground that are more than 100 years old. Those are breaking,” he says, explaining municipalities need to invest more rather than taking the band-aid approach they used so far.

Travel and Hospitality

Travel has also been good for engineering firms. The improving economy has people booking trips for vacations and business. As a result, Hoyle Tanner has seen a roughly 10 percent increase in work at general aviation airports since 2015, Low says.

He says there has been a slight increase in construction of resorts and hotels in the past few years. One such project Hoyle Tanner recently worked on is the River Walk Resort at Loon Mountain in Lincoln. Located on the site of the former Franconia Paper Mill, Phase 1 of the $30-million project wrapped up in 2016. The 153,000-square-foot project includes a seven-story building with 79 luxury suites.

Hoyle Tanner worked on the development of the River Walk Resort at Loon Mountain. Courtesy of Hoyle Tanner.

Slowing Sectors

Others sectors, though, have been sluggish. Construction of big box retail stores is down, says Clarke with Allen & Major. As a result, engineers have to get creative with the empty spaces left behind.

As big box stores move out, smaller retailers and medical offices have moved in, Clarke says. “We just finished up a project on South Willow Street in Manchester where Sports Authority moved out” and the space was divided into three units.

Duval says even though investment in big-box retail is down, mixed-use centers that have a retail component, like Market and Main, are doing well.

And while there has been investment in some infrastructure, engineers argue there needs to be more. Low says roads, highways and bridges have always been a fairly consistent source of work, but the funding for these projects has begun to stall.

“We’re all eagerly anticipating what may happen in Washington D.C. with a transportation bill,” Low says, speaking of President Trump’s stated intentions of developing a massive plan to build and refurbish infrastructure nationwide.

“I think most of our clients are also in a holding pattern in regards to that as well. We’re not seeing as much of a push for that right now, but I think the need still far exceeds the available funding for roadway and bridge infrastructure.”

Until such a plan is enacted, Low expects investment in such infrastructure to remain flat and focused on maintenance and preservation.

He says this has actually been a problem for a long time and stems from road and highway projects largely being funded through the gas tax. “Without an increase in the gas tax or an alternative mileage tax or tolls or something like that, the curves are divergent,” Low says. “The need is climbing, the costs are getting higher to maintain the infrastructure, but with higher efficiency vehicles, plus hybrid and electric vehicles that aren’t contributing to the gas tax, they are using the roads but not paying for them.”

Shedd remains optimistic. “I think there’s a lot of potential still in transportation simply because, again the infrastructure is aging,” he says. “There’s been kind of a delay or postponement in monies that are spent in transportation for political reasons. They can only postpone the inevitable for so long.”

Current Issue - April 2024

Current Issue - April 2024