Today’s economy is a mashup of Goldilocks and Little Red Riding Hood. Just like the porridge Goldilocks ultimately finds, “The economy is not too hot or too cold,” says Russ Thibeault, president of Applied Economic Research in Laconia. With economic growth at 2%, inflation below 2%, 130,000 new jobs in September and unemployment at a 20- to 30-year low, “The porridge is just right.”

Today’s economy is a mashup of Goldilocks and Little Red Riding Hood. Just like the porridge Goldilocks ultimately finds, “The economy is not too hot or too cold,” says Russ Thibeault, president of Applied Economic Research in Laconia. With economic growth at 2%, inflation below 2%, 130,000 new jobs in September and unemployment at a 20- to 30-year low, “The porridge is just right.”

But, don’t get too comfortable, there are wolves at the door, Thibeault warns. Business investment and confidence have sharply declined. Europe is in a recession. China’s economy is slowing as the tariff war slows manufacturing and causes uncertainty.

This is not another dark tale about a bad recession looming. Because economists say that while there are areas of concern, the U.S. economy continues to grow even if at a slower pace.

The worry is that if a crisis were to send the economy spiraling, “We don’t have any bullets to take out the wolf,” Thibeault says.

He explains that during a recession, the feds drop interest rates to spur borrowing and policymakers slash taxes to hike spending. Unfortunately, we already have low interest rates and just received one of the biggest tax cuts in history, Thibeault adds. And to compound potential economic woes, we now have a trillion-dollar deficit, caused by the tax cuts, which could exacerbate a recession.

He explains that during a recession, the feds drop interest rates to spur borrowing and policymakers slash taxes to hike spending. Unfortunately, we already have low interest rates and just received one of the biggest tax cuts in history, Thibeault adds. And to compound potential economic woes, we now have a trillion-dollar deficit, caused by the tax cuts, which could exacerbate a recession.

“We’ve already fired that gun and the wolf is still at the door,” which means policymakers won’t have ammunition to fight a recession should one come, he says. If a recession bites, it may not be deep but it could last a long time, Thibeault says.

Strong Indicators

Brian Gottlob, director of NH’s Economic and Labor Market Information Bureau, agrees. While there are some troubling indicators, including the manufacturing slump that resulted from the tariff wars, there is nothing to suggest the country is entering a recession. “For the most part, the economy has performed well,” he says. “Nothing that says in the next several months we’re likely to tip into the recession.”

While a familiar refrain is that we’re “overdue” for a recession because of our 10-year recovery, said recoveries don’t die of old age but rather from other mitigating factors says Kenneth Entenmann, chief investment officer and director of institutional services for NBT Bank. He points out the last four economic expansions lasted roughly eight years. “We are currently in the longest expansion in U.S. history.”

Concerns over a pending recession were spurred by the inverted yield curve in late summer—when yields on 10-year U.S. Treasury notes fell below yields on two-year notes. Typically, an inverted yield curve heralds a recession and the time between the inverted yield curve and a recession is about 14 months.

Concerns over a pending recession were spurred by the inverted yield curve in late summer—when yields on 10-year U.S. Treasury notes fell below yields on two-year notes. Typically, an inverted yield curve heralds a recession and the time between the inverted yield curve and a recession is about 14 months.

“History tells us an inverted yield curve is the result of the fed raising interest rates too far too fast,” Entenmann says. “The concern is the fed will be too aggressive and choke off the economy.

“This time is different. There are a lot of political events artificially influencing long-term rates and the yield curve and many economic indicators are still strong,” Entenmann says. (The yield curve did flatten by October though that can mean a loss of investor confidence.)

When looking at the economy, there is still plenty of good news. Thibeault says, “New Hampshire reflects the national economy: good job growth, low unemployment. The state’s economy is in very good shape.”

While a housing crisis marked the 2008 recession, NH’s real estate market is strong. Housing prices are up 5% year over year and overall sales are trailing off due to a shortage of housing stock, Thibeault says, adding the housing market is in a good position to weather an economic downturn.

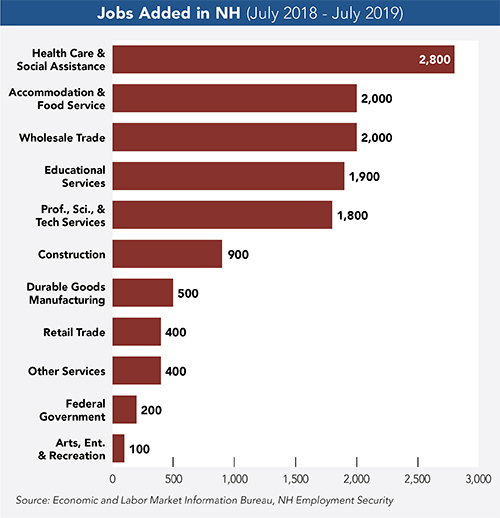

Gottlob adds that, while construction has slowed, it remains strong. “There’s a lot of building in a lot of places,” he says, noting employment gains in the construction sector are among the highest of any sector. He balances that by saying, despite dramatic employment gains, the number of construction jobs has yet to reach pre-2008 levels.

Annette Nielsen, an economist with the NH Economic and Labor Market Information Bureau, is also bullish. “Right now, the economy is very good,” she says, and it is bolstered by a strong regional economy, particularly around Boston.

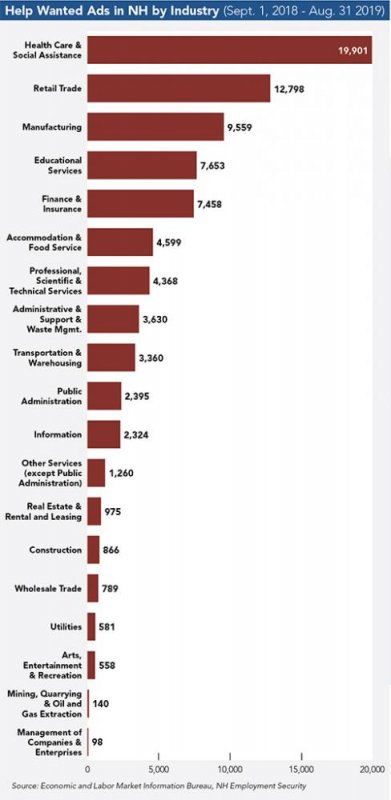

She points to business services, technology and health care as particularly robust sectors in NH and adds Manchester and Portsmouth have the strongest job growth statewide.

She points to business services, technology and health care as particularly robust sectors in NH and adds Manchester and Portsmouth have the strongest job growth statewide.

Job Market

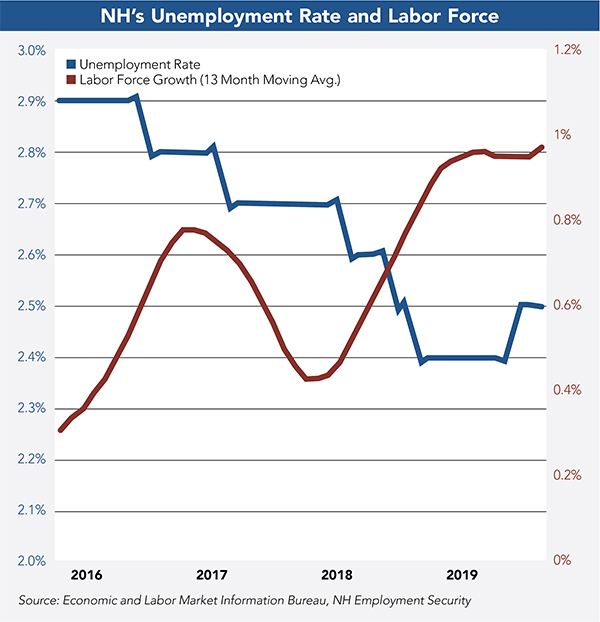

Regarding the broad job market, the state’s unemployment has not risen above 3% for more than 45 months, says Nielsen.

“The labor force and labor market are growing in tandem. It keeps the same level of unemployment, which is very low.”

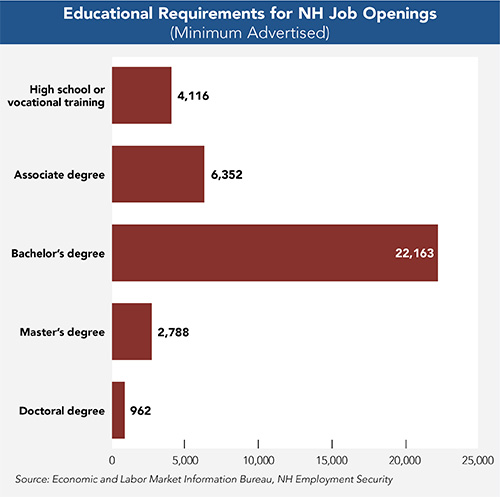

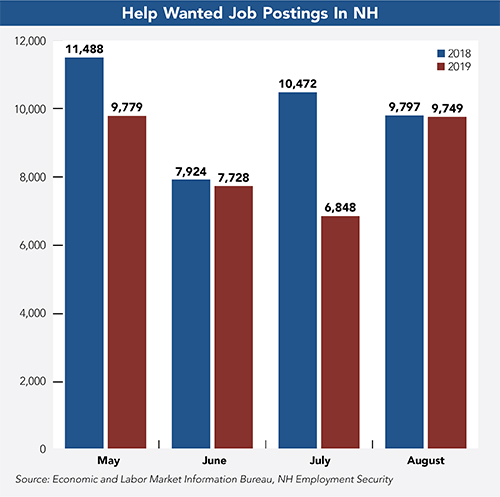

Gottlob says, “While job expansion is slower, it should be enough to absorb those entering the job market… In New Hampshire, we have far more openings than people to fill them.”

Other than manufacturing, most major sectors are experiencing job gains, Nielsen says. Gottlob adds new jobs are at both ends of the economic spectrum, from lower-paying retail and hospitality jobs to higher-paying construction and health-care positions.

But recruiting and retaining employees is vastly different, depending on sector. Retail and hospitality have large turnover rates, contributing to their constant demand for employees, while health care, tech and manufacturing have lower levels of turnover but difficulty in finding workers with the right skill sets to fill open positions, according to Gottlob.

“We have a tight labor market but we also have a skills mismatch,” he says. “We end up adding more of the jobs that are lower skill because it is easier to qualify for those jobs. That has an impact on aggregate wage trends. I am convinced we have more demand for high-wage jobs than we have supply and that’s a real issue.”

Consumer Spending

A healthy job market and rising wages have consumers feeling good. Entenmann says wage growth is improving and approaching historic averages and growth is picking up momentum. Gottlob also notes wages have been increasing during the past two years, spurring consumer confidence and spending. “We rely on the strength of the consumer sector to keep the expansion rolling as businesses have clearly started to cut back,” he says.

And consumers are indeed spending. Entenmann said retail was strong during the summer months, with online sales increasing by 16%.

Trade and Manufacturing

Trade and Manufacturing

Two areas of big concern are trade policy and manufacturing. While strong export activity boosted manufacturing in NH, Gottlob says annualized export growth has slowed down in the two most recent quarters.

“We had a great story to tell with exports for a while,” he explains, adding the recent slowdown in export activity is a “self-inflicted wound” from recent trade policy. “We’re disrupting international trade. That never helps the world economy.” (For more information on trade volatility’s affect on NH businesses, see page 48.)

Manufacturing was among the sectors hardest hit in 2008, but Nielson says NH clawed back 5,000 of the 10,000 manufacturing jobs it lost. She also says manufacturers invested in automation, which has softened their workforce needs.

The political and policy landscape nationally and globally are the wild cards that will determine the continued health of the economy. “The policy uncertainties are unlike any other time I can recall,” Gottlob says.

Current Issue - April 2024

Current Issue - April 2024