The phones have been quiet lately in the office of Manchester bankruptcy attorney Malcolm Blackwood (pictured). With the COVID-19 pandemic triggering an economic slowdown, and unemployment at levels usually associated with devastating recessions, that may seem counterintuitive.

The phones have been quiet lately in the office of Manchester bankruptcy attorney Malcolm Blackwood (pictured). With the COVID-19 pandemic triggering an economic slowdown, and unemployment at levels usually associated with devastating recessions, that may seem counterintuitive.

“I do a lot of networking, and every conversation is the same: ‘You must be as busy as ever,’” says Blackwood. “Actually, if the phone rings, I’m surprised.”

It’s been a slow year for bankruptcy lawyers in NH, but Blackwood predicts that will soon end. “We’re in the middle of a tough nine to 15 months, then there’s going to be a giant wave.”

It is an assessment shared by other lawyers and analysts who crunch the numbers.

The infusion of government money into personal and business bank accounts; a federal moratorium on foreclosures and evictions that continues to Dec. 31; limited access to the courts; and what Blackwood describes as a general atmosphere of “forbearance” have all combined to keep the cork on a potential flood of foreclosures and bankruptcies.

“There are not a lot of tangible repercussions to not paying debts right now,” says Blackwood, “and people who are not getting squeezed generally do not avail themselves of bankruptcy options. If you call any bank, for any reason, you’re going to be greeted by a recording about accommodating COVID-19. Basically, all the banks are working with people.

“If you don’t want to pay something or are unable to pay a credit card, student loan, car loan, your lender almost certainly has some sort of option for you, and that is really what has turned off the bankruptcy spigot.”

Historic Lows

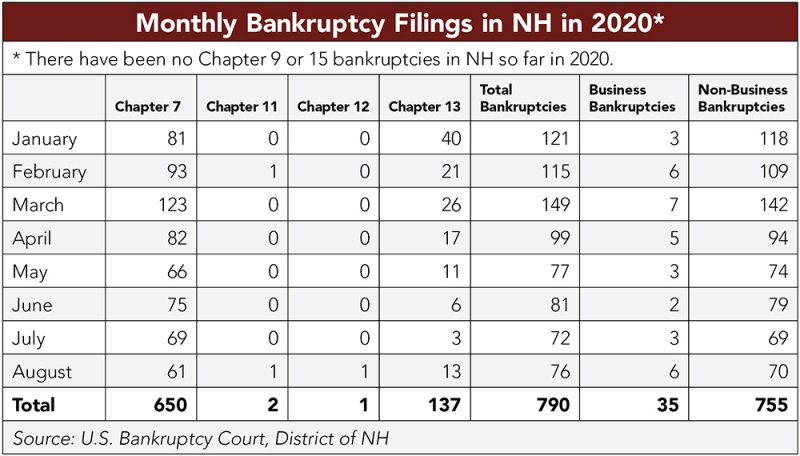

Bankruptcy filings for NH residents and businesses were already running at historic lows in the first quarter, with 121 in January, 115 in February and 149 in March. The state saw only 99 bankruptcy filings in April, and between 70 and 80 in every month through September. Most of those were personal bankruptcies, with only two business bankruptcies in June and four in August.

Foreclosures have seen a similar pattern, running between 120 to 140 a month from September 2019 to March 2020, then dropping to between 10 and 40 a month from April to August.

But at some point, according to Blackwood, “The piper is going to have to be paid.” That point is predicted to come midway through 2021. The warning signs are abundant. There are people living on unemployment benefits, raiding retirement funds and falling behind on mortgage and rent payments. Some businesses have been surviving on federal funds, extending lines of credit, leveraging whatever assets they have.

In parts of the country, the rate of bankruptcies and foreclosures is starting to climb precipitously, according to James Hammond, CEO of New Generation Research, which specializes in crunching the numbers at bankruptcydata.com. “We are seeing an acceleration in bankruptcies that is unprecedented,” he recently told Fortune. “I’m pretty confident we will see more bankruptcies than in any business-person’s lifetime.”

The NH Advantage

Hammond was alluding to the situation nationally, which is not necessarily how things will play out in NH. Businesses and individuals here have historically done better than national averages in avoiding bankruptcies and foreclosures. In total bankruptcy filings per capita between 2000 and 2019, NH was among 16 states where bankruptcies were 25% below the national average, according to the American Bankruptcy Institute.

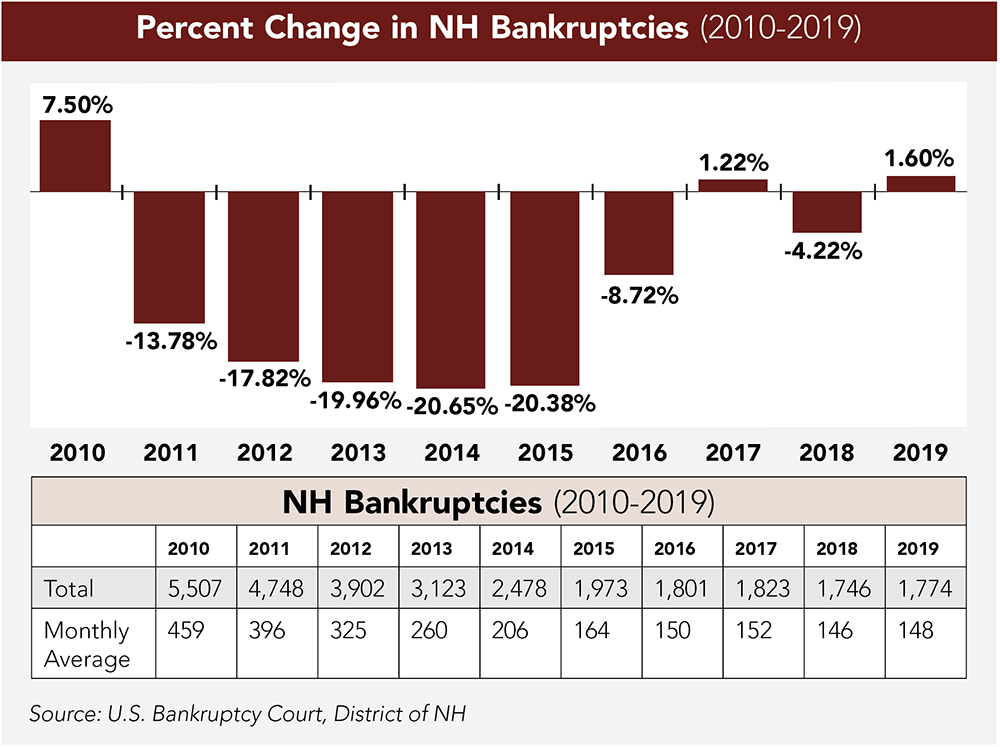

The number of bankruptcies in the Granite State over the past two decades was 30% below the national average, in a period that included the dot.com bust, post-9/11 slowdown and the Great Recession of 2009-2010.

New Hampshire is also among 11 states to see the most dramatic improvement since 2010. Across the country, bankruptcies declined 51% on average between 2010 and 2019, while in NH they dropped by 68%.

In an interview with Business NH Magazine, Hammond says the Granite State has fared well so far, but will not be entirely spared the consequences of the COVID-induced slowdown. “We have gotten back to business to a degree,” he says, “but it’s still way down, particularly in certain sectors. And the population is terrified. I’m not going to speculate on the rightness or wrongness of that, but you can’t deny it. Even when things reopen, you have extreme caution from people. They are risk averse in ways they have never been. And some of the most risk-averse people are those with the most money … the older folks.”

An Early Indicator

A canary in the coal mine for NH is the delinquency rate for mortgage loans on residential property, which rose to 6.29% at the end of the second quarter. That’s an increase of 2.5% from the first quarter, according to the Mortgage Bankers Association.

But even the bad news is not as bad for the Granite State. Among the 50 states and DC, NH ranked 38th for mortgage delinquencies after two quarters of 2020, meaning only 12 states did better. New Jersey ranked highest in delinquencies with a rate of 11%.

Based on current trends, Attom Data Solutions predicts that residential foreclosures nationally could increase significantly by the end of the third quarter 2021. In NH, Attom estimates that foreclosure filings could increase from an estimated 382 by the end of September 2020 to 1,674 by the end of September 2021, a 338% increase.

That analysis was released in July, before the Federal Housing Administration (FHA) announced the third extension of its foreclosure and eviction moratorium through Dec. 31. “The ominous projections are far from a guarantee and, even if they come true, envision less severe damage than what happened during the foreclosure wave that hit during and after the Great Recession of the late 2000s,” states Todd Teta, chief product officer at Attom.

Clouds on the Horizon

While the COVID-induced contraction may not hit the NH housing market as severely as during the Great Recession, business bankruptcies could exceed the levels of 2009 to 2011, according to Hammond. “I think it’s inevitable,” he says.

“We have been blessed with low levels of bankruptcy in our lifetime. We had a fairly scary episode 10 years ago, but this is different. This is affecting so many more sectors. In 2009, it was a financial crisis. You had bankruptcies but you didn’t have a huge failure of businesses in so many areas. It stands to reason, with the economic brakes we had to apply, there will be consequences.”

Bankruptcies filed nationally halfway through 2020 suggest which industries will face the greatest challenges in 2021. The hardest hit sector has been restaurants, with 530 seeking bankruptcy protection or liquidating, followed by construction (498); real estate (480); medical (466); oil and gas (419); retail (362); and transportation (303), according to bankruptcydata.com.

“What we have not seen in a long time, and people aren’t prepared for, is a broad-scale, multi-industry pandemic of bankruptcy,” says Hammond. “That’s the great risk here. That impacts jobs. It impacts spending patterns. It impacts disposable income. We are a nation built on the notion of growth, not shrinkage, and we don’t know what to do in shrinkage. We really don’t experience it very often.”

Meanwhile, lawyers like Blackwood are cutting expenses, dipping into reserves and holding on for an anticipated boom of bankruptcies, with some businesses facing greater headwinds than others. “I worry about commercial landlords,” says Blackwood. “I’ve been downtown since 2005, and my Manchester building has always been full. Now, my floor has emptied out.”