The need for speed, security and a better user experience is driving fintech trends in the banking industry, from automated processes and robots to data-driven online systems that can approve a loan in minutes.

New Hampshire Banking Commissioner Jerry Little says institutions have seen huge technological change, much of it driven by consumer demand. “Customers want to use their phone or laptop to manage as much of their financial life as they can,” he says.

The NH Bankers Association, a statewide trade association, has an IT committee that meets quarterly to discuss current challenges and examine ways to be a resource to fellow members. “Keeping up with the latest technology is a major priority for banks in order to give consumers what they expect in banking,” says Kristy Merrill, the association’s executive director.

She says the association is also part of the American Bankers Association, which is working closely with heads of major technology providers of the core systems that process transactions within a bank. “We are very supportive of the work they are doing in this area and are watching very closely to see if the scales can be balanced so banks have more control over their access to and use of technology,” she says.

Real-Time Payments

Real-Time Payments

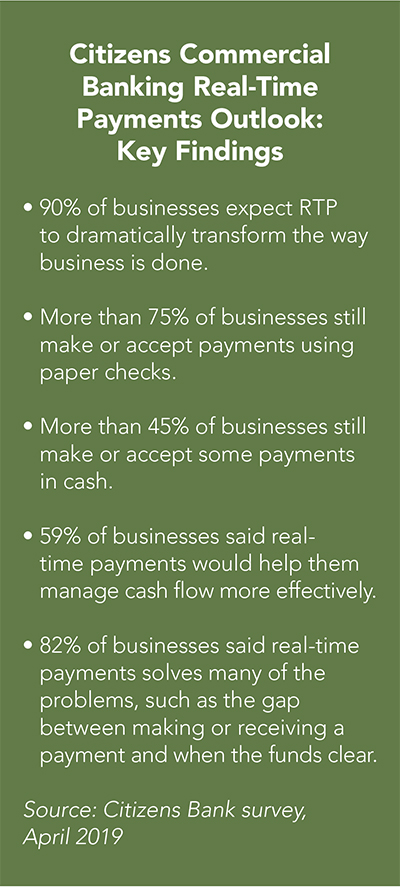

A big technological shift in the banking world, real-time payments (RTP), is being hailed as a game-changer for the way currency is exchanged. “Everyone agrees the U.S. needs a better mousetrap. If you had a clean sheet paper and a pencil and set out to build a system that meets modern expectations, [RTP] is what you would build,” says Matt Richardson, head of product solutions at Citizens Commercial Banking.

Richardson says RTP is a new payment rail (method) in the U.S. “Most are familiar with traditional payment rails, such as cash, checks and credit cards. On the commercial side there’s ACH [automated clearing house network] and wire transfers.

Most consumers experience ACH through direct deposit,” he says. “But headed into 2020, the U.S. economy really needed a rail for a modern digital economy and that is real-time payments.”

ACH is the network that allows for billions of direct deposits, direct pays and electronic checks. It is a batch-based system, which means payments are made at short intervals, each day, with most occurring the day after a transaction was requested.

While its faster than waiting for the check to come in the mail, it is far from instantaneous. All ACH requests go through either the Federal Reserve or The Clearing House, a banking association and payments company owned by the largest commercial banks that dates back to 1853.

“You have to plan today to get the money tomorrow. Wire transfers are instant but are very expensive and only available during bankers’ hours, so nights, weekends and holidays don’t exist for ACH or wire. RTP throws out all the old banking conventions and settles instantly or within seconds,” Richardson says. “If a business wanted to originate a payment on a Saturday at 1 p.m., under ACH, you got the money Tuesday. With real-time payments you get the money on Saturday at 1 p.m.”

Another advantage of RTP is the ability to link relevant information to the transaction itself. “RTP is built on a modern messaging standard [ISO 20022] so that the data about the payment travels with it. It avoids confusion over what the payment is for,” Richardson says.

Jessica Cheney, vice president of product management and strategic solutions at Bottomline Technologies in Portsmouth, says the ability to send messages on the same rail is significant. Before RTP, a business might communicate about an invoice via email, not through the bank’s channel. Now that interaction between parties actually happens through the bank, a more secure option, especially in light of the persistent threat from email fraud related to fake invoices. Prior to RTP, having to accept a payment without knowing how to apply it had been a pain point for businesses, Cheney says.

Bottomline Technologies, a longtime fintech player based in NH, is expanding its Digital Banking IQ suite by launching a real-time payment module. Cheney says RTP allows scheduling of online payments so companies can hold onto cash as long as possible.

“Nobody should pay sooner than they need to,” says Richardson of Citizens. “If you are the payor, why not enjoy the benefit of cash in your account? So, it’s not about fast payments, it’s about payment certainty—the ability to be precise about when a payment is going to be made and received. It allows you to choose when to pay.”

It is a useful tool, for example, for power companies to collect from their customers. If the utility is threatening to turn off the service, the payment can be handled immediately, he says.

RTP is expected to be quickly adopted by companies, Cheney says “because real-time payment has become the norm for individuals, where people expect money to go from point A to B instantly. That pressure is spilling over into the business world, especially in B2C areas like insurance claims. …The consumer expectation is there, so to have a leg up, companies will start offering RTP [so they can] stand out from competition.”

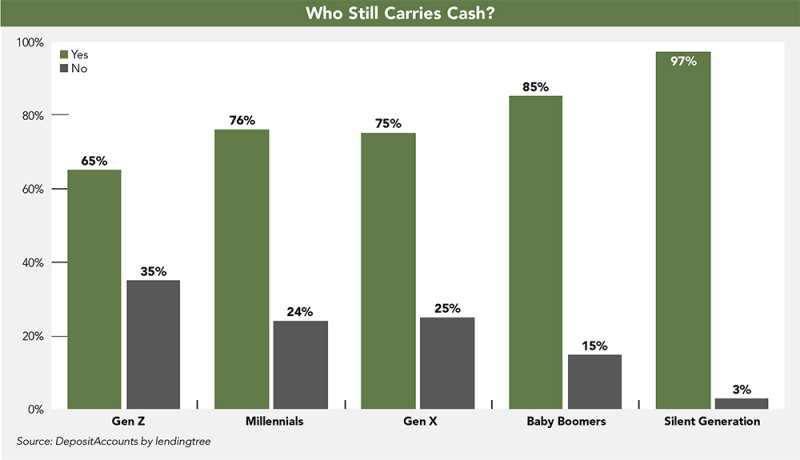

Richardson says consumers are already using services such as Zelle and Venmo, which allow for the instant exchange of money. Uber and Lyft offer the ability to settle out at the end of the day. With the gig economy, those workers expect to work and be paid the same day.

The banking eco-system is becoming more real-time payment-oriented, says Richardson. He adds the system isn’t just for big banks. “The way RTP was built, it was always intended to be available to all banks in the U.S., with no favoritism, regardless of the size of bank. The commitment was that everyone would have access at the same price point. The best way to make something universally adopted is to make it ubiquitous,” he says.

Security is Paramount

Banking commissioner Little says consumers assume banks are responsible for all security. “It’s a big cost factor as banks try to live up to these expectations,” he says.

Real-time payments are a big improvement over ACH because, as Richardson explains, it ensures that money is only moving if a sender originates it. “The trader can send the request for payment and say, ‘Here’s your invoice and link. We are requesting you pay us.’ The recipient [via app or online] can go in, view, agree to pay, click a button and the payment is made.”

Technology around security continues to evolve in a constant race to stay ahead of the fraudsters. St. Mary’s Bank, a credit union in Manchester, allows customers to turn credit and debit cards off and on directly through its digital platform.

But offering multiple services means more to guard against bad actors. “Vendor due diligence is a constant effort. Medium and small institutions cannot have a team for that so the level of vendor scrutiny is huge, along with investment in systems to identify suspicious activity—whether it’s card usage or logins from another state,” says Ken Senus, COO of St. Mary’s Bank.

Keeping Up With Customer Demand

At smaller banks and credit unions, customers expect the personal touch but still demand the latest technology. Senus says from an institutional perspective, it is tough to stay competitive. “We can’t just look at what other credit unions and banks are doing. We look at all technology to see what else is available, [such as] a platform that offers a loan decision in minutes.”

He says members want digital banking tools that function the same across multiple devices. St. Mary’s is working to put Zelle, a payment service, within the bank’s mobile application. Zelle and Venmo allow users to send money to friends instantly.

Venmo charges a fee, but Zelle, which was created by financial institutions for financial institutions, does not.

What makes Zelle secure is that the funds are transferred from an account at one financial institution directly into another and are always insured under a financial institution, states a St. Mary’s spokesperson. Venmo, on the other hand, allows its users to keep a balance with them before depositing into a financial institution, the spokesperson says, and is not insured until it is deposited.

Bots in Banking

At Service Credit Union in Portsmouth, time-consuming, routine tasks, especially those associated with auditing daily transactions at its branches worldwide, are being accomplished through robotic process automation (RPA). Repetitive tasks, such as reconciliations or unique but recurring tasks, such as posting an overseas travel notification to prevent a credit card from being shut down, are routines the robot can learn. Tyler Pihl, vice president of audit for Service Credit Union, says RPA is a cost-effective method of accomplishing these tasks.

“We’re looking at all kinds of technology—digital and robotic process automation, AI, machine learning, and cloud computing,” says Geoff Gilton senior vice president of technology for the credit union.

Gilton says RPA is a technology applicable to any industry, so there isn’t a need to create a bank-specific software or programming. “It’s a game changer from compliance standpoint,” says Phil, explaining that once a process is tested and validated, the RPA eliminates human error.

RPA also provides analysis that would not be possible otherwise. “When you design a process, you can ensure that it creates logs for every transaction. Then you can produce the documentation for audit teams,” Gilton says. “We will increasingly have data we can analyze to improve processes, drive efficiency and gain new insights. As manual processes, we did not get the data.”

Senus at St. Mary’s says data intelligence also gives insight into members’ needs. “How and where they do transactions and what activities take place at branches allow us to do more predictive modeling so we are not blasting everyone with an email about a student loan product. We are being more intuitive and educated in how we interact with members,” he says.

Service Credit Union’s Pihl points out that RPA does not eliminate jobs. “We are in a position where we can’t fill all the jobs.

Some staff are overworked. RPA enables us to meet staffing needs by rolling processes up into RPA. Removing a simple task that is labor intensive can reduce the staffing burden. It really is making it easier for our staff,” he says.

In branches, the highest turnover position is teller, so allowing and encouraging members to use mobile apps and electronic options frees staff for other tasks or more time with members, says Senus.

The Need for Speed

Small businesses demand speed; whether it is a credit decision or access to information, says Ken Martin, managing director at Portsmouth-based CIT Small Business Solutions. “When it comes to small business and technology, the number one thing we work on is speed and one of the key pieces of technology that CIT relies on is a point of sale platform that enables us to provide that speed,” he says.

Martin says years ago, customers seeking credit would be dealing with faxes and paper forms and multiple trips to a bank or loan office. “Having an automated end-to-end financing system delivers quick decisions often within minutes,” he says, without having to go to the bank.

CIT worked with national market research firm Harris on a survey to learn what small businesses are looking for when it comes to technology. Based on polling, 42% see technology investments as a top driver of growth over the past year. Looking ahead, 52% plan to invest in cloud computing, 48% in customer relationship management tools and 47% in cyber-security and data privacy.

Fraud prevention is big, says Martin. “I have been in three meetings in the past 30 days making sure our fraud protection is the best it can be. The discussion around technology and loss prevention are always top of mind, but 20 years ago was not even on the radar,” he says.

When asked about the top technology concerns, 56% of the survey respondents cited the risk of a security or data breach, 41% pointed to the uncertainty about how new tech would affect existing systems and 32% cited not having enough capital to invest.

Martin says businesses know they need to invest in tech to grow and the ability to get something quickly and put it in place really depends on timely access to capital.

Technology Saves the Trees

Banking has always required lots of paperwork, but Senus says technology is chipping away at the mountains of forms.

“We launched a new interactive mortgage origination system where the member fills out an application and they don’t have to pull bank statements or payroll records from multiple sites,” Senus says. “You can link providers and the information comes in automatically. It eliminates a lot of emails and makes for a much more successful origination.”

In this fast-paced, ever-changing world, banks and credit unions have to be adaptable to compete.

“We always have to challenge the way things are done,” says Senus “Every employee and manager has to ask how can we do it better. We always have to be nimble.”

Current Issue - April 2024

Current Issue - April 2024