The economic recovery from the pandemic-induced recession may be just around the corner, but it’s coming too late for many businesses. A headline from the Feb. 26 edition of the Washington Post sums it up: “The wave of COVID bankruptcies has begun.”

“A year into the pandemic, bankruptcies have soared for businesses in real estate, energy, retail and other industries that can no longer pay their bills,” the Post reported. But not every business closing needs to end in bankruptcy, according to legal and financial experts. Business owners can wind down operations without destroying their credit or good standing in the business community.

Business ownership, especially for the small business owner, is as much an emotional investment as a financial one. Closing the doors can be traumatic. That’s where avoidance and wishful thinking can set in. There’s a big difference between planning for a turnaround and hoping for one.

A business owner may know in their heart that they can persevere, but if the numbers suggest they are headed for the fiscal cliff, it’s best to act while they can wind down operations without bankruptcy protection. Many businesses that could have worked out a closure without involving the bankruptcy courts fail to do so by waiting too long.

“The big thing is making the decision early enough so you don’t get into trouble,” says CPA John Forgiel of Bradford. “Just realize it’s time to end this, and wind up the operation as cleanly as possible. If you have accounts receivable, try to collect those; pay employees; and pay the bills or at least reach out to your creditors to make arrangements.”

Forgiel helped a large construction company wind down operations a few years ago and found that most unsecured creditors are willing to work with the business owner when they know that failure to do so will leave them standing in line for cents on the dollar in bankruptcy court.

“I spent quite a bit of my time reaching out to creditors and found that the worst thing you could do is not be in touch with them,” Forgiel says. “As soon as you miss a payment, they are going to be on you worse than if you gave them a phone call and said, ‘This is where we are at right now.’”

Forgiel also works for Supporting Strategies, a Boston-based firm for businesses that want to outsource bookkeeping and controller services.

Many firms use software such as Fathom, Futrli or Domo to help predict revenue and other trends many months into the future so as to enable closure decisions based on sound data.

“Obviously, it’s only as good as the information you are putting in, but these programs link to your bank account and try to be predictive,” says Forgiel. “The big thing is getting some training in the software or making sure that if you have accountants, or a CPA, that they are using this type of software.”

Paying and Informing Employees

Paying and Informing Employees

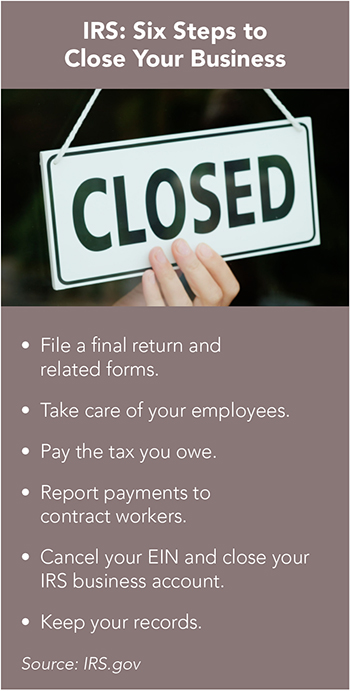

Once the decision to close has been made on the basis of a sound financial analysis, Manchester Attorney John Ward says tax and payroll obligations are the first priority to avoid legal problems. “Whenever a business shuts down, it’s a sad thing, but you want to have a system in place and be organized to do it in a way that you uphold your obligations to creditors, to taxes and to staff as much as possible” he says.

One of the hardest parts of a closure is staff notification. “You want to make sure you review the issues with employees, let them know what the exit plan is, and try to give them notice if you’re comfortable with that,” Ward says.

Some employers don’t inform employees until the very end, trying to avoid bad publicity or the premature loss of needed manpower. But most of the time, such an approach only creates more problems than it solves. “There are risks associated with transparency,” says Ward, “and it really depends on what type of business you are in and the level of comfort you have with the people you are working with. But when it’s a choice between transparency versus the opposite, I would choose transparency as the best you can do as a business owner.”

Ward recommends having an attorney review any written notification to staff about the upcoming closure and the terms for employees. If a business owner plans to make a verbal presentation, it would be a good idea to have their lawyer at least review the talking points.

Leave In Good Standing

Business owners planning to close need to get as much money as possible from the sale of their remaining assets, and that means avoiding a fire sale when possible, according to Lori Liberty, principal at Melanson CPAs in Merrimack.

“If you are a restaurant in town, more likely than not, you are going to know the other restaurants,” she says, “So find a strategic buyer, like one of your competitors who may be doing better than you. Maybe you can get a little more for that inventory and equipment than if you advertise a fire sale. You need to allow time for that, and if you don’t have time, it does come down to a fire sale.”

The gold standard for successfully closing a business is the “certificate of good standing” from the Secretary of State, according to Duy Nguyen, CPA and manager at Melanson. “Once you have that, it’s like a get-out-of-jail free card from the state,” Nguyen says. “It says you did everything you needed to do to shut down your business, and your account is in good standing.”

Another consideration is to make sure all payroll taxes are current because this is one area where there will be no forbearance, according to Liberty. “When it comes to debt, the debt surrounding payroll taxes will never leave you,” she says.

“They will haunt you to the grave because, in theory, that is not your money; that money belongs to someone else so the IRS is very unforgiving if those debts aren’t paid.”

So, what are the biggest mistakes business owners make when shuttering the enterprise? “The opposite of everything we mentioned,” says Nguyen. “Ignoring debts, using a fire sale to unload assets, not filing taxes because you assume you lost so much you don’t need to file taxes, and not registering with the state that you closed your business, because if you don’t do that, they are still going to come after you for taxes and annual reports.”

Current Issue - April 2024

Current Issue - April 2024