New Hampshire’s real estate sector finished 2018 on solid ground. Median sale prices surged, and homes took less time to sell than in 2017. Meanwhile, the economy remained strong, and the tight labor market suggests 2019 could be another good year.

Despite these and other positive trends, there are signs of a slowdown ahead. One of the biggest potential drags on the housing market comes in the form of rising interest rates. Rates under 4 percent are long gone, and rates exceeding 5 percent could soon be the norm.

Buyers with good credit could still get 30-year fixed mortgages for around 4.75 percent as of early January 2019. But some people in the industry expect rates to jump to as high as 5.5 percent by this time next year.

Chris Masiello, president and CEO of Better Homes and Gardens Real Estate— The Masiello Group, hasn’t seen much of an effect from rising mortgage rates. “Interest rates have risen from the low 4 percent range to high 4 percent to low 5 percent range in the last year,” says Masiello, whose Keene-based company has nearly three dozen real estate offices in Maine, NH and Vermont. “In and of itself, the increase has been anticipated and built into the market, and has not had much if any negative impact on this housing cycle.”

He adds that loan underwriting guidelines have loosened somewhat over the past 18 months, coinciding with rising wages for many workers.

Market in Transition

Many Realtors have a similarly rosy outlook. But Russell Thibeault, president of Laconia-based real estate consultants Applied Economic Research, doesn’t share their enthusiasm. He sees a market in transition, and one that could face significant headwinds from rising rates.

“In my 50 years of experience, it is almost universally the case that rising rates have a perceptible and negative impact on housing prices and liquidity—meaning how easy it is to sell a house,” he says. “That is compounded now because we have a combination of rising prices and rising interest rates. Really, they magnify each other.”

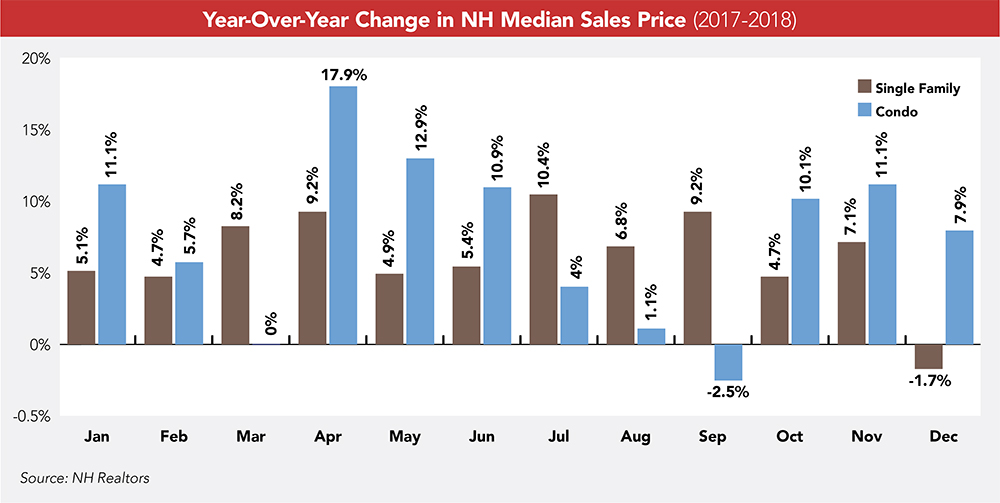

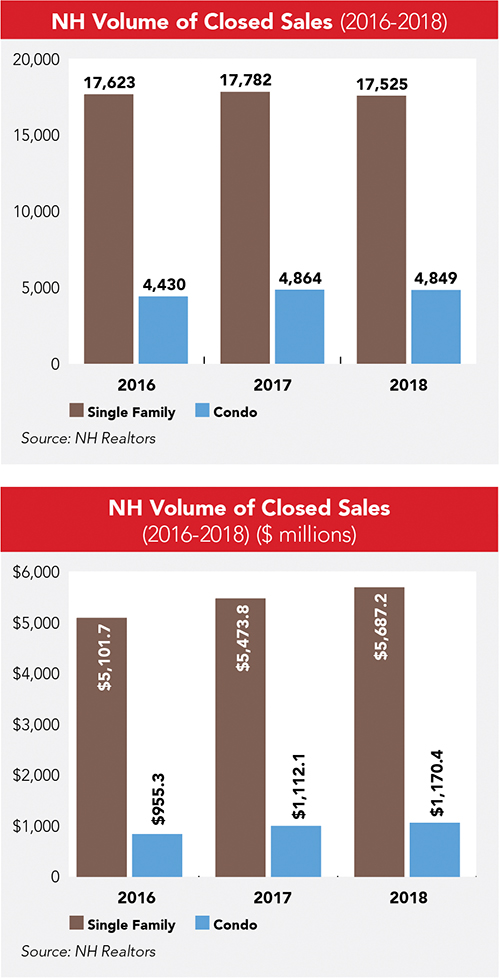

Year-end data from the NH Association of Realtors suggests that there was a strong housing market in 2018, but not overwhelmingly so. Compared to a year earlier, the median home price rose 6.8 percent in 2018 to $205,000. Homes sold, on average, in just 52 days in 2018, nearly 20 percent faster than in 2017. Sellers also got nearly 99 percent of their asking price in 2018.

The data isn’t entirely positive. Total home sales were effectively flat in 2018 with 4,849 total closings, and the number of new listings dipped by 1.5 percent for the year to 5,613 homes. Perhaps most telling: Total home sales fell in each of the last four months of 2018, capped by an 11 percent drop in December.

The Affordability Question

People tend to purchase as much home as they can afford, and affordability is generally determined by the monthly payment. Rising interest rates mean higher monthly payments, and over time they will price some buyers out of the market. Fewer would-be buyers can drag down demand and with it bring down home prices.

The Federal Reserve in December raised its benchmark rate from 2.25 to 2.5 percent—its highest level in 10 years—and additional rate increases are possible over the coming year. Mortgage rates are tied to yields on U.S. Treasury notes rather than the Federal Reserve benchmark. That said, higher interest rates are generally reflected in higher Treasury yields, which lead to higher mortgage rates.

Consider this example. A $200,000 home bought with a 30-year fixed-rate mortgage of 3.5 percent would have a monthly payment of $898 plus property taxes. The same $200,000 home bought with a 30-year mortgage at 5.5 percent would cost $1,136 a month, a difference of $238 a month and more than $2,800 a year.

Consider this example. A $200,000 home bought with a 30-year fixed-rate mortgage of 3.5 percent would have a monthly payment of $898 plus property taxes. The same $200,000 home bought with a 30-year mortgage at 5.5 percent would cost $1,136 a month, a difference of $238 a month and more than $2,800 a year.

Though that difference might seem stark, Hampton-based mortgage broker Jay Healy notes rates didn’t jump overnight. Historically low rates of 3.5 percent or so haven’t been available for more than two years. A year ago, for instance, 4.25 percent was the rock-bottom rate available for a 30-year loan.

He admits mortgage rates starting with the number “5” might be something of a psychological hurdle, at least initially. But he doesn’t believe many people actively looking to buy when rates are at 4.75 percent will be priced out at 5.25 percent. Based on that scenario, a $250,000 home, he says, costs only $78 more a month at 5.25 vs. 4.75 percent.

Mixed Expectations for 2019

“We think it’s going to be a good year,” Healy says, noting that demand is still robust in Rockingham and Strafford counties where the company does much of its NH business. “I still think demand for housing will be strong enough to where an increase in rates of 0.5 points is not going to drive housing prices down.”

Rather than pricing people out of the market, Healy believes climbing rates could compel more people to act before rates rise even higher. By year end, he expects to see rates as high as 5.5 percent for a 30-year mortgage.

Joy Tarbell, a longtime realtor in Mt. Washington Valley and principal of JT Realty—Keller Williams Lakes and Mountains, says the market remains strong. She sold $6 million worth of real estate last year, including a $740,000 home in December and a $440,000 condo in early January that had multiple offers.

“Both of these are well above the current average list price of $330,000 for residential properties in the Valley, so it’s great that we’re still attracting the higher-end buyers,” she says.

Thibeault, the real estate economist, doesn’t doubt that 2018 was strong for many realtors. But he expects rising interest rates will affect the market—even if it’s not yet showing up in the data.

“I don’t think it has filtered through the numbers yet,” he says. “The numbers are usually a couple months old, and it’s the off-season. If rates continue to be close to 5 percent or above, then I think you will really start seeing a difference in the [sales] numbers in the spring and into the summer selling season.”

Over time, he says, the most likely effect of rising rates will be a softening of home prices. At the very least, they will not rise as fast as they have in recent years. He also believes the market is currently transitioning from a sellers’ market to one where buyers have more leverage.

Nationwide, there are also signs of a real estate slowdown. The S&P CoreLogic Case-Shiller, the repeat-sales home price indices, fell by one-tenth of a point in December, and Fannie Mae’s 2018 Home Purchase Sentiment Index (HPSI) decreased in December. The Fannie Mae data also shows fewer people believe now is a good time to buy a home.

Those big trends aside, Masiello notes all real estate markets vary by community and often neighborhood by neighborhood. Overall, he says, the NH outlook is positive for the foreseeable future.

Current Issue - April 2024

Current Issue - April 2024