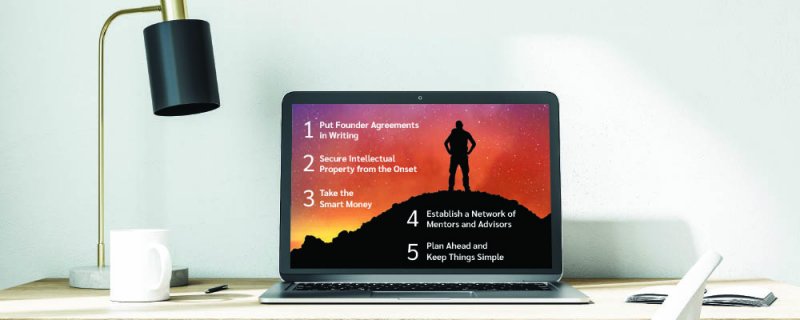

Entrepreneurs that are building a company for the first time can be rattled when things don’t go as expected. While making mistakes is part of the growth process, being prepared to avoid unnecessary, and potentially costly, pitfalls will help ensure that the company is built on a solid foundation.

Put Founder Agreements in Writing

In instances where a company has more than one founder, agreements relating to the founders’ respective contributions and ownership of the company should be put in writing. Written agreements provide clarity and force a discussion of potential issues before they arise, when it can be much harder to come to an agreement. Verbal agreements, or poorly constructed written agreements, can lead to founder conflict, which can be fatal for an early-stage company.

Co-founders’ initial contributions, whether in the form of money, technology or other intellectual property, a hard asset or services, and the value of such contributions should be discussed and documented. Expected future contributions, roles and responsibilities should also be addressed. Will both founders work full-time for the company? If so, are their ownership interests subject to vesting so that they are incentivized to fulfill that contribution over a certain period? What financial obligations do the founders have to the company?

Rather than talking about ownership of the company in terms of percentages, which can shift over time and be misleading, agreements should refer to ownership in terms of concrete amounts of equity, such as shares of stock or units of membership interest. Founders should also consider whether transfer restrictions or repurchase rights should apply to such equity under certain circumstances; for example, if one founder can no longer actively contribute to the company.

Secure Intellectual Property from the Outset

Intellectual property, including trademarks, copyrights, patents, trade secrets and know-how, can be an essential part of a company’s value proposition, but if the company’s ownership of these intangible assets is not locked down from the outset, it can be extremely difficult to clean up later.

To the extent that the founders have worked on developments relating to the company’s business before the entity was formed, those developments should be assigned into the company as soon as possible after formation. It is also important to consider what restrictions may be imposed by founders’ former employers. For example, is one founder subject to restrictions on how confidential information (including trade secrets) and developments are used after the term of employment? Are they subject to non-competition and non-solicitation obligations that could create an issue?

Going forward, each employee and contractor should sign an agreement that addresses confidentiality and ownership of developments and related intellectual property rights before commencing work with the company. Any developments that the service provider works on for the company should be owned by the company, and when the service provider’s engagement or employment ends, they should not have any rights to take those developments or confidential materials with them.

Finally, if it is necessary to disclose certain aspects of confidential information to third parties, a confidentiality agreement should be signed first. While confidentiality agreements are necessary forms of intellectual property protection, the first line of protection should be to not disclose anything confidential or proprietary unless absolutely necessary.

Take the Smart Money

Finding the funding necessary to scale a business can be one of the founders’ top challenges, but strategically selecting the right investors and the right type of investment rather than hastily accepting the first big check presented will help the company to achieve many of its growth objectives. Not all money is created equal, and the best money comes from investors that can contribute something to the business besides money, whether that is leadership, mentorship, or access to potential customer networks and other valuable connections. Ideally, smart money investors are familiar with the relevant industry and sector and understand the company’s vertical. Additionally, the founders and investors should have mission alignment.

When it comes to early-stage financing, there is no one-size-fits-all solution. Founders should carefully consider the different funding options that exist for early-stage companies, the unique needs of the company, the specific stage that the business is in, and the company’s short-term and long-term growth goals.

The more investors that are involved in a fundraising round, the higher the costs and the more difficulty the founders will have balancing the perspectives of everyone involved.

Plan Ahead and Keep Things Simple

Entrepreneurs can underestimate the time and cost involved in scaling the company, but factoring in unexpected delays, costs and challenges, while simplifying solutions wherever possible, will help to avoid surprises. Raising capital always takes more time than expected, and revenue usually comes more slowly than anticipated, but being conservative in estimates and planning can help avoid a situation where a short runway forces desperate or hasty decision making.

Additionally, be calculated about when to seek funding, as the process of finding a funding source and then negotiating and finalizing the transaction can be a significant distraction from running the business itself. Founders should always be prepared to pivot as a result of unanticipated changes.

Entrepreneurs pride themselves on originality and their problem-solving skills but can develop a solution that is more complicated and more expensive than anticipated and requires more nuanced and tailored documents. Founders can avoid this issue by seeking recommendations from experienced advisors as to what a simple structure would look like.

Establish a Network of Mentors and Advisors

Early in the startup’s journey, founders should prioritize establishing the right network of mentors and advisors, as that will be critical in navigating early obstacles. Ideally, mentors are industry veterans, potentially in the same geographic area, who have already navigated similar issues and can now provide advice with the perspective that comes from hindsight. Mentors do not need to be assigned, as the best mentor relationships typically develop organically. Mentors could take on a more concrete role, such as a seat on the company’s board of directors or board of advisors or could simply be an informal sounding board.

Investing in good advisors, including legal and financial advisors, from the beginning can avoid significant issues and expenses down the road. Lawyers and accountants are essential in building a solid foundation for a company. Startup advisors should understand the unique challenges faced by startups and should be prepared to offer flexible and affordable advice for entrepreneurs. Additionally, advisors should understand the company’s business and industry, as well as fundraising options.

Emily Penaskovic is a corporate attorney at Sheehan Phinney in Manchester, where she advises entrepreneurial clients on a variety of business matters, including entity formation, capital raising, and corporate governance. She is also on the board of directors of the NH Tech Alliance and co-chairs its Startup Committee. She can be reached at epenaskovic

@sheehan.com.